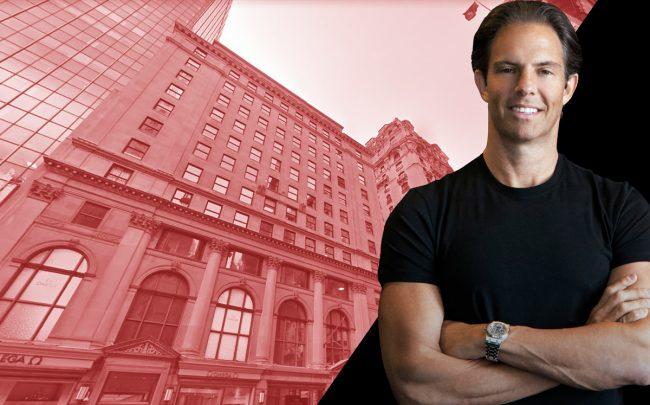

The Coca-Cola building at 711 Fifth Avenue and Michael Shvo (Credit: Google Maps)

A partnership led by Michael Shvo has secured a $545 million loan to refinance the Coca-Cola building, The Real Deal has learned.

The loan, provided by Goldman Sachs and Bank of America, will replace $600 million debt at the iconic property at 711 Fifth Avenue. The transaction closed last week, according to people familiar with the deal. JLL represented Shvo’s group.

Goldman Sachs declined to comment. Bank of America did not respond to a request for comment.

Shvo’s group — which includes Turkish developer Bilgili Holding, private equity firm Deutsche Finance America and German pension fund Bayerische Versorgungskammer (BVK) — acquired the property in September for $937 million.

The new loan covers only 90 percent of the existing debt at the building, provided by JPMorgan. The bank initially held $700 million debt in the building, but $100 million was paid off by BVK, the primary equity partner, when the acquisition occurred. Alongside the new financing, BVK poured an additional $55 million into the building to cover the difference, a person familiar with the transaction said.

Shvo’s takeover of the building has been closely watched. Last year, the building’s namesake owner, the Coca-Cola Company, snubbed Shvo’s group and chose to sell it to a partnership consisting of Nightingale Properties and Wafra Capital Partners for $909 million — almost $50 million lower than Shvo’s initial offer.

Weeks after the building sold to Nightingale’s group in September, the building was effectively flipped to Shvo’s group in a transaction that valued the building at $937 million. Questions were later raised about why Coca-Cola overlooked a higher bid, and what advice it received from its brokers at Cushman and Wakefield.