WeWork is trying to keep its locations staffed by offering a $100-per-day incentive.

The co-working company has left many of its locations open, arguing that some of its tenants provide essential services. Now, WeWork is now trying to entice its employees to show up with a daily $100 bonus, the New York Times reported. The internal memo obtained by the Times promised employees that they would get paid the bonus for all days they worked in a monthly lump sum payment.

WeWork has officially allowed its employees to work remotely but since its locations are still accessible to members, the company is trying to ensure a skeleton staff is still available.

The co-working company’s response to the coronavirus pandemic has been criticized, particularly after members tested positive for Covid-19 at a handful of New York locations. In the locations where this occurred, WeWork responded by temporarily closing the office for cleaning before reopening the following day, Bloomberg reported.

Customers that rent space at WeWork locations have reported having difficulty cancelling their contracts with the company as WeWork continues to demand rent payments, according to Bloomberg. At the same time, the company has reportedly approached at least one London landlord about rent concessions on its master lease. WeWork declined to comment on Bloomberg’s story.

Read more

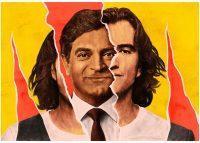

The pandemic could deal a fatal blow to the co-working company, which has been trying to get back on its feet after a botched attempt to go public with a new CEO Sandeep Mathrani at the helm. Co-working competitor Knotel’s founder and CEO Amol Sarva, which has also been keeping locations open and asking customers to continue paying rent, admitted to Bloomberg that “I’m pretty sure that workplaces will never be the same after this.”

At the same time, WeWork’s largest backer SoftBank Group has advised the co-working company’s shareholders that it may renege on part of its rescue package. At least two of WeWork’s board members claim that SoftBank is “obligated” to follow through with a $1.1 billion loan tied to a tender offer to buy $3 billion of existing shares in the company, according to the Times. SoftBank’s offer was expected to be completed by April 1. [NYT, Bloomberg] — Erin Hudson