Related tries to calm Israeli investors after market panic

Related tries to calm Israeli investors after market panic

Trending

Extell’s Israeli bonds put on downgrade watch

Pandemic has stopped Central Park Tower construction, closed sales offices

Another New York real estate developer is attracting concerned looks from the Israeli bond market, as the coronavirus epidemic has brought construction and sales in the city to a near halt.

A week after Related Companies’ bonds were downgraded, Gary Barnett’s Extell Development saw its bonds given a negative projection by rating agency Midroog, according to a disclosure published Sunday on the Tel Aviv Stock Exchange.

“The rating has been placed under credit review as a result of the spread of coronavirus around the world and particularly in New York, which is expected to impact the company’s pace of sales, its cash flows, and the progress of development projects,” the agency’s announcement states.

Read more

Related tries to calm Israeli investors after market panic

Related tries to calm Israeli investors after market panic

Gary Barnett facing rising backlash in Israel over $75M payout

Gary Barnett facing rising backlash in Israel over $75M payout

Extell bonds downgraded in Israel, but remain low risk

Extell bonds downgraded in Israel, but remain low risk

Extell did not respond to a request for comment.

Statewide orders by the Cuomo administration have forced the developer to close sales offices at all of its projects and work has stopped at the Central Park Tower, which topped out in September. The ultra-luxury sector is particularly vulnerable to deterioration in this macroeconomic environment, Midroog notes.

Extell’s bonds are rated A3. Any further downgrade would bring the rating into B territory, characteristic of “speculative” investments.

Midroog previously downgraded Extell’s bonds from A2 to A3 in 2017, citing New York City’s softening luxury market as a primary factor. In 2018, Extell faced a bondholder lawsuit and an investigation from the Israel Securities Authority amid concerns about the firm’s liquidity.

Last week, Related Companies’ Israeli bonds were downgraded from A+ to BBB by Standard & Poor’s after an annual earnings report revealed concerns about its ability to repay maturing bonds during a financial crisis.

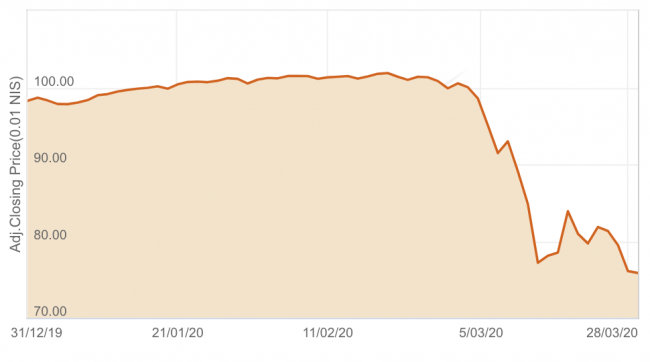

Extell’s bonds are now trading at about 76 cents on the dollar, down nearly 25 percent from the start of the year. That is even worse than the 16 percent decline of the Tel Bond Global index — which tracks foreign bond issuers, including many New York-based real estate firms — over the same period.

Extell Series B bond price over the past three months (Credit: Tel Aviv Stock Exchange)