“In moments of crisis,” the legendary developer Big Bill Zeckendorf was fond of saying, “one’s world tends to become simplified.” Even those with big dreams (pretty much every successful real estate professional) get down to the basics: survival.

This is a crisis unlike any we’ve ever seen. The world has stopped. “It’s the first time ever that we’ve had a chain of supply shock to the system and a demand shock,” developer Steve Witkoff said. To help the U.S. economy recover from that shock, the government has passed a $2 trillion economic stimulus package, the largest in modern U.S. history.

What sort of help can the real estate industry expect?

The Real Deal‘s editorial team has broken down key aspects of the stimulus package that are most relevant to stakeholders from across the industry, from multifamily landlords to residential brokers, from lenders to builders to investors. Much of what exactly the stimulus will mean for real estate is still being hammered out, but this is a snapshot of the current state of play.

“A good first step,” is how REBNY president Jim Whelan described the stimulus to us. He did note, though, that “increasing attention is going to have to be paid to the commercial market — mortgages, lenders, as well as landlords.”

Landlords and Investors

The stimulus package offers no direct relief for landlords. They might find respite indirectly, however, through the one-time $1,200 check to most individuals making up to $75,000. Unemployment insurance has been expanded to include gig workers, with the federal government offering up to $600 per week on top of what states provide. Renters (and homeowners) can use that cash to make their monthly payments.

However, Fannie Mae and Freddie Mac are offering borrowers hurt by the pandemic up to 90 days of forbearance as long as they do not evict renters. For those who own Section 8 properties, the stimulus provides $1 billion to help maintain normal operations and “make up for any reduced tenant payments as a result of the coronavirus,” according to law firm Nixon Peabody.

Alan Hammer, a multifamily-focused attorney at Brach Eichler, is urging clients to reach out to existing lenders to see what programs they could qualify for, in lieu of federal or state help.

“There’s nothing really in the CARES Act that provides for landlords,” Hammer said, referring to the stimulus package’s official name — Coronavirus Aid, Relief, and Economic Security Act. “But you’ll never hear me complain that life has been unfair to landlords as a group.”

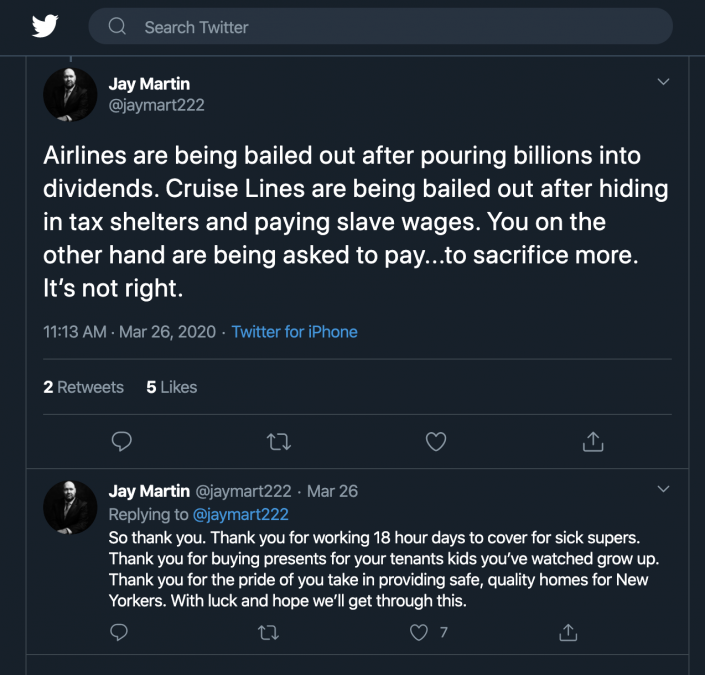

Jay Martin, executive director of landlord group CHIP (Click to enlarge)

Francis Greenburger, who heads development firm Time Equities, said the plan “could be better,” adding that 90-day forbearance programs may not be helpful in the long run.

“Kicking the can down the road is not as good as it sounds if the crisis is still here in three to four months,” Greenburger said.

There is, however, one provision tucked into the bill that could let big landlords reap big savings.

Under the existing tax code, landlords can use losses including depreciation to offset other taxes up to a total of $250,000 for individuals and up to $500,000 for joint filers. The new stimulus lifts that restriction for three years, and the New York Times, citing a draft congressional analysis, estimated that the program could result in investors saving $170 billion over 10 years. (All taxpayers with depreciable assets or losses will also be eligible, so it’s unclear how much of that sum would represent savings in real estate.)

Depreciation on prime real estate holdings can easily come out to millions of dollars a year. According to one tax attorney, a $100 million building with “straight-line” depreciation over a 40-year lifespan would yield $2.5 million in depreciation losses a year. Depending on the owner’s income in a given year, the removal of the “excess business loss” cap could yield substantial tax savings.

The stimulus also allowed lawmakers to mend a “drafting error” from the 2017 tax reform — also known as the “retail glitch” — which made interior improvements for nonresidential properties ineligible for bonus depreciation. Retailers and restaurants will now have the option to deduct 100 percent of the cost of such improvements in the first year, instead of depreciating it over several years — an option which machinery owners, for example, already had.

Affordable Housing Developers

The bill will also add significant liquidity to municipal markets. The Fed is now exercising its power to buy municipal bonds, which the stimulus expanded to include all types of bonds, not just short-term ones. Because bonds allow municipalities to raise money cheaply, that’s good news for affordable housing developers who use tax credits to finance their projects.

Developers say enabling such construction is more important than ever.

“Affordable housing could be more dramatically affected in the short term,” said Ron Moelis, CEO of L+M Development Partners, one of the most active affordable housing developers in New York City. Moelis said more tenants who need affordable apartments may lose their jobs because “they don’t have as much of a social safety net.”

Agents and Brokerages

Brokers used to eating what they kill are usually left out of government bailouts. Not this time.

Unlike previous stimulus packages, this one extends unemployment insurance to independent contractors, which is how the majority of the nation’s 2 million real estate agents operate. (The amount is based on individual state formulas, and would be in addition to the up to $1,200 for individuals earning $75,000 or less.)

For brokerage firms, the Small Business Association has two loan programs — including one that may cover the cost of lost commissions.

The Paycheck Protection Program provides loans up to $10 million to cover rent, mortgage interest, utilities and payroll. According to the National Association of Realtors, lost commissions count as payroll. The other loan program, dubbed the Economic Injury Disaster Loan, provides a $10,000 advance on emergency loans. The loans are limited to $2 million.

SBA loan payments will also be deferred for six months.

REBNY’s Whelan said he was happy to see the small business assistance programs centered around employment. “That was thoughtful and will hopefully play a critical role in getting businesses back on their feet,” he said.

The measures come as welcome news for firms that are already reckoning with significant layoffs or pay cuts, among them Compass, Realogy and Meridian Capital Group. But given that commissions are the bulk of a broker’s income, layoffs even in bad times are less common than in other industries. “There isn’t a tendency to go in that direction,” said CBRE’s Mary Ann Tighe.

Rent, however, is a real concern. “I promise you other brokerages are not paying rent,” said Stephen Shapiro of L.A. luxury firm Westside Estate Agency.

Retailers and Small Businesses

Similar to brokerages, retailers, restaurants and other small businesses are eligible for the Paycheck Protection Program.

Businesses with fewer than 500 employees are eligible for the loan program, which is designed to preserve jobs. The U.S. Small Business Administration said it will forgive loans “if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.”

“This should give landlords some comfort that their tenants will be able to pay rent eventually,” said Jeff Friedman, a partner at law firm Hall Estill, “if not immediately.”

Lenders

Tom Barrack already thinks it’s the end of CMBS as we know it.

The founder of Colony Capital and close associate of President Trump penned a dire letter on Medium March 22 in which he predicted that the coronavirus pandemic and subsequent shutdown of sectors of the U.S. economy could lead to margin calls, foreclosures, evictions and even bank failures. The impact, the polo-playing billionaire warned, could be greater than that of the Great Depression.

What happens to mortgage servicers remains unclear. Last week, the Mortgage Bankers Association estimated that lenders could be on the hook for at least $75 billion on short notice, and possibly more than $100 billion if homeowners and landlords sought forbearance en masse.

But the association noted that the stimulus “includes funding that can be leveraged to create a broad, dedicated Federal Reserve liquidity facility.” It called for the government and the Fed to rapidly establish a program to help mortgage servicers provide the necessary forbearance.

Heidi Learner, chief economist for Savills, noted that “while servicers can go into the facility to borrow from the Fed, the fact of the matter is that it’s a cash-negative position.”

“They have to borrow to advance cash that’s not coming in,” Learner said. “I don’t see how this is sustainable.”

Construction

Hardhats can expect significant support. Infrastructure and construction could be eligible for $43 billion of the $340 billion outlined in the appropriations section of the package, according to trade publication Engineering News-Record.

Trade group Associated General Contractors told the publication that the stimulus provisions that would help the industry include ones that allow companies to delay paying payroll taxes through Jan. 1 and allow firms to “carry back” net operating losses for five years to offset past earnings. Another section of the bill allows firms structured as partnerships, S-corporations and other pass-through entities to deduct all 2020 losses in the current tax year.

Construction workers could also avail themselves of direct payments from the government, and smaller construction businesses would also be eligible for the same types of SBA loans that brokerages can get.

REITs

Real estate investment trusts are mentioned briefly in the bill — but only to exclude them from part of a temporary change to rules around net operating losses.

Most companies that paid taxes in recent years but had losses later on may be able to obtain tax refunds by carrying those losses back for up to five years.

In a memo analyzing the stimulus package, law firm Skadden Arps said that “despite the provision of this relief, loans, leases and other contracts likely will need to be restructured and renegotiated. Property owners, operators and lenders will need to collaborate to make this happen.”

Big Bill Zeckendorf would have agreed with that sentiment. The rotund tycoon accumulated suits with the same gusto that he did properties, and once said of his tailor: “By now he knew that I would always pay. But he also knew that he might have to wait.”

This special report was written by Hiten Samtani and Danielle Balbi, with reporting from TRD’s Georgia Kromrei, Rich Bockmann, Kevin Sun, E.B. Solomont and Kathryn Brenzel.