The governor has said New Yorkers coping with the coronavirus crisis should look for a silver lining. Now, his transit agency and his favorite mayor have found one.

The Metropolitan Transportation Authority has reached a deal with Mayor Bill de Blasio on how to share revenue on the redevelopment of the MTA’s former Madison Avenue headquarters by a private-sector player.

It took years to come to terms. The MTA initially sought to capture the project’s revenue stream directly — some $1.3 billion over a 99-year ground lease — but the city wanted property taxes from the developer, slated to be Boston Properties.

Read more

Eventually, they decided to route $600 million through the city and into transit improvements, counting that money toward de Blasio’s pledge to contribute $2.66 billion toward the MTA’s unfinished 2015 to 2019 capital plan.

In a statement, Deputy Mayor Dean Fuleihan called the solution “creative.”

But the idea was hardly novel. Something had changed: The coronavirus pandemic has battered the transit agency and city government alike, costing each entity billions of dollars (and afflicting Patrick Foye, the MTA’s chairman and CEO, with Covid-19).

For both parties, the sooner the 1960s-era structure and two similar adjoining buildings can be replaced with a modern, rent-generating office building, the better.

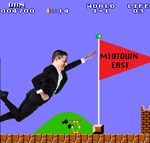

Originally called the Equitable Trust Building, 347 Madison Avenue, at East 45th Street, served as the MTA headquarters for 35 years — along with 341 and 345 Madison — until the agency decided in 2011 that it needed money more than an office tower in the heart of Midtown.

In 2014 the MTA moved the top layer of its infamously extensive bureaucracy to 2 Broadway and has since been shelling out about $4 million a year to maintain the 20-story building it abandoned. Boston Properties was conditionally selected from among nine bidders to turn it into a 900,000-square-foot cash machine.

The transit agency was blunt about its goal: reap as much revenue as possible. Now, with most of its 6 million daily ridership sheltering at home and its massive workforce still being paid, the agency needs every nickel it can get.

“The deal embodies the MTA’s commitment to maximize the value of its assets for the public’s bottom line,” said Janno Lieber, president of MTA Construction & Development, in a press release announcing the deal.

“With the MTA and our government funding partners still assessing the budgetary implications of the coronavirus pandemic, this funding is more important than ever,” added Robert Foran, the MTA’s chief financial officer.

The de Blasio administration touts the pending project as fruit from the Midtown East rezoning it ushered through the City Council in 2017. Over the life of the ground lease, 347 Madison Avenue is expected to generate more than $1 billion for transit projects, including a new subway entrance on Madison Avenue with a direct connection to Grand Central Terminal and the Long Island Rail Road terminal slated to open underneath it in 2022.

The agreement was needed for the Madison Avenue project to begin the city’s land-use review process. That requires City Council approval — and another round of negotiations, albeit this time with a seven-month time limit. Requests from the local member could include privately owned public spaces, local hiring, streetscape improvements, cash for local nonprofits and community meeting space.