The Federal Reserve is injecting an additional $2.3 trillion in loans to bolster a frozen economy, which continues to be on lockdown as the spread of the coronavirus accelerates.

Thursday’s financing announcement came as the U.S. Department of Labor reported that another 6.6 million Americans filed jobless claims last week. That figure was down from the adjusted prior amount of 6.8 million, but the total of Americans who have asked for relief, mostly because of coronavirus-related business shutdowns, has skyrocketed to almost 17 million over the past three weeks.

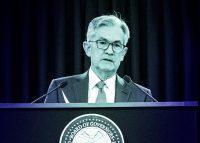

“Our country’s highest priority must be to address this public health crisis, providing care for the ill and limiting the further spread of the virus,” said Fed Chair Jerome Powell as part of the announcement. “The Fed’s role is to provide as much relief and stability as we can during this period of constrained economic activity, and our actions today will help ensure that the eventual recovery is as vigorous as possible.”

Read more

Among the central bank’s steps announced Thursday include boosting liquidity to financial institutions making loans through the Small Business Administration’s Paycheck Protection Program, designed to keep workers on the payrolls of small companies. The Fed also said it would buy up to $600 billion in loans through the Main Street Lending Program, which will provide four-year loans to companies with up to 10,000 workers or revenues less than $2.5 billion, with principal and interest on those loans deferred up to a year.

The Fed also will increase the flow of credit to households and businesses by supporting up to $850 billion in credit. To do so, the Fed will be expanding the scope of three existing credit facilities, and the central bank is aiming to assist state and local governments that may be experiencing cash-flow issues because of the coronavirus by setting up a credit facility that would provide up to $500 billion in loans.

The coronavirus has taken a huge toll on the U.S. economy, particularly on small and mid-sized businesses in the retail and hospitality sectors, as millions are now out of jobs because of government-mandated closures aimed to curtail the spread of Covid-19. For the first week in April, over 925,000 Californians have filed for jobless claims, down from nearly 1 million the week before. In New York, another nearly 345,000 employees did the same, though that also was down from about 367,000 the week prior, according to the advance state claims reported by the DOL.

The Federal Reserve has already taken a series of historic measures, from buying back mortgage-backed securities to slashing interest rates to almost zero percent, to help prop up the U.S. economy, which has nearly come to a complete standstill.

Some observers have noted that the measures will do little to aid those with commercial mortgage-backed securities (CMBS) loans that aren’t secured by government agencies like Freddie Mac. Experts also have previously said that the Fed’s move could leave out companies in the mall and hotel space.

Write to Mary Diduch at md@therealdeal.com