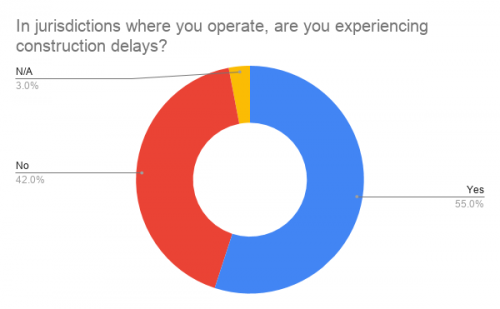

A survey of 135 multifamily construction firms conducted from March 27 to April 1 by the National Multifamily Housing Council found 55 percent were experiencing construction delays.

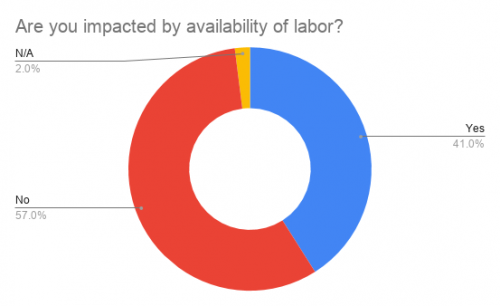

In the early days of the coronavirus scourge, U.S. builders’ main concern was disruption in the supply chain for materials from hard-hit areas, notably China and Italy. But as the U.S. has become an epicenter of the crisis, with social distancing and construction moratoriums proliferating, materials are quickly becoming a secondary concern.

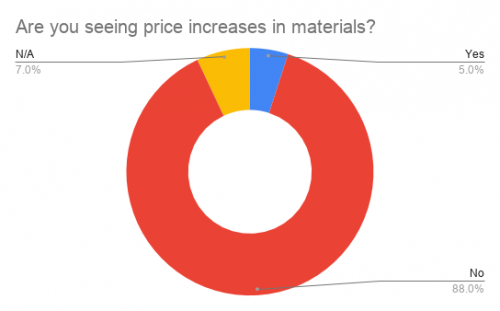

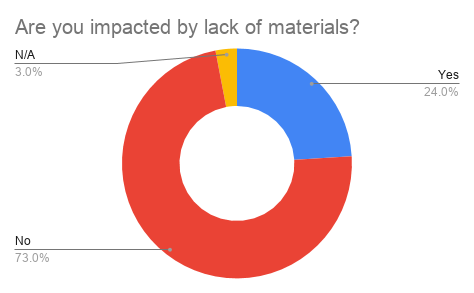

Among those experiencing delays, the biggest causes were slow permitting (76 percent), a construction moratorium (62 percent) and delays in starts (59 percent). Meanwhile, 73 percent responded that lack of materials had not had an impact, and 88 percent reported that prices for materials had not risen.

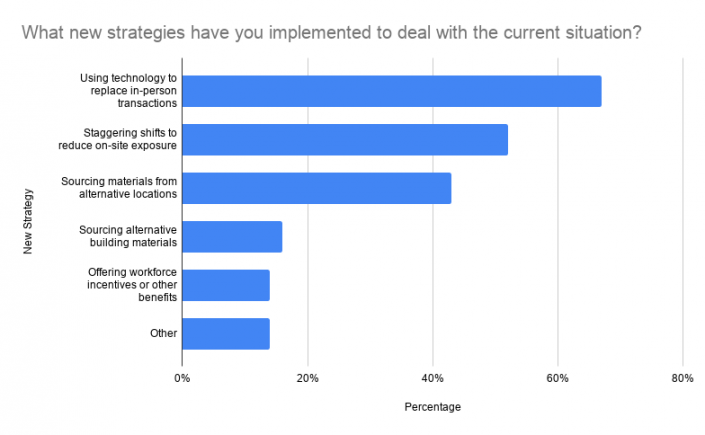

Most companies are also pursuing new strategies in response to the pandemic. Of the 73 percent of respondents who said they had implemented new strategies, two-thirds were “using technology to replace in-person transactions like inspections and approvals,” 52 percent were “staggering shifts to reduce on-site exposure” and 43 percent were “sourcing materials from alternative locations.”