New York City could lose up to 475,000 jobs by next March and $14 billion in tax revenue over the next three years due to the economic effects of Covid-19, according to a new report.

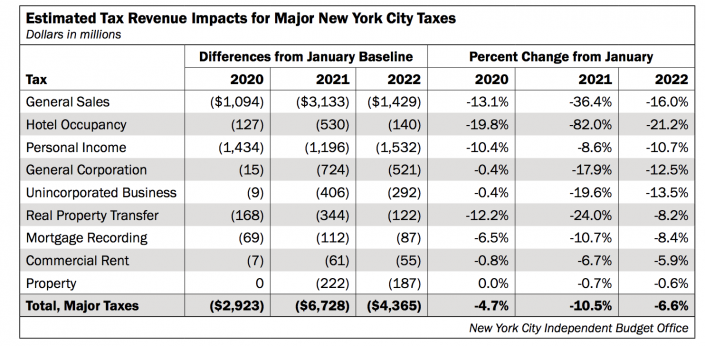

The city’s Independent Budget Office estimates that tax revenue could respectively drop $2.9 billion, $6.7 billion and $4.4 billion below previous projections in fiscal years 2020, 2021 and 2022. The forecasts are based on the assumption that the city will lose 475,000 jobs between the second quarter of 2020 through the first quarter of 2021. The estimated decreases are relative to revenue predictions released by the IBO in February.

With the spread of coronavirus, the residential market has slowed, while many real estate companies have furloughed or laid off employees. Of the jobs the IBO estimates could no longer be around by next year, about 100,000 would be in retail, while 86,000 would be in hotels and restaurants.

“In terms of its impact on employment, a recession in which the city lost 475,000 jobs would be the worst it has faced since the early 1970s,” the report, released Wednesday, stated. The tax revenue losses would also be the most dramatic seen since that period, it added.

Real estate-related revenue — from property, hotel occupancy, mortgage recording, commercial rent and property transfer taxes — would account for a $2.2 billion drop over the next three years, according to the IBO report.

The largest decrease, according to the report, would be in hotel occupancy taxes. Projected revenue in fiscal year 2020 would fall $127 million (19.8 percent) below the IBO’s earlier forecast of $643 million; $530 million (82 percent) lower than the $647 million predicted for 2021; and $140 million (20.2 percent) below $660 million in 2022.

Property taxes, the city’s largest source of revenue, would see the smallest declines percentage-wise, according to the IBO. There would be no decrease in 2020 and a difference of $222 million (down 0.7 percent) from $31.3 billion in 2021 and $187 million (down 0.6 percent) from $32.6 billion in 2022, the report states. But longer-term, property tax revenue could take a larger hit.

“In subsequent years, however, it is likely that revenue would show substantial effects from a recession as severe as the one in our scenario,” the report states.

Real estate transfer taxes would plunge $634 million from the IBO’s predictions. But the report warns that “little is known about the persistence of the Covid-19 crisis and how long the economy must remain shut.”

“There is great uncertainty about the depth and duration of the expected recession and the strength of any post-recession bounce — let alone the recession’s eventual impact on tax revenue,” the report cautions.

Write to Kathryn Brenzel at kathryn@therealdeal.com