The number of private real estate investment deals plunged worldwide last month, the latest example of the coronavirus’ all-consuming effect on the global economy. And so far, April has been even worse.

Commercial real estate deals were down nearly 43 percent in March year over year, according to data from research firm Preqin. North America was essentially the same with a 44 percent drop.

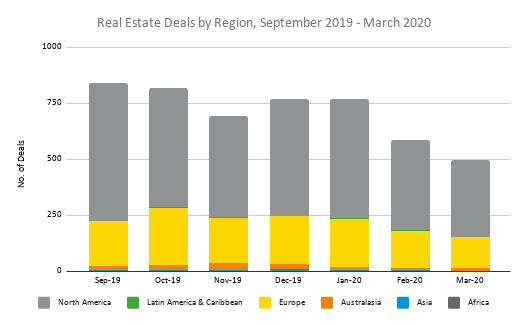

(Credit: Preqin)

In April, deal volume on the continent has cratered nearly 67 percent.

The drop has tracked with the pandemic’s spread across the globe. There were 495 deals globally in March, down from 588 the month before, according to Preqin. And in April, just 160 deals have been done.

In Asia, where the coronavirus originated — it was first reported in China in late December — just two deals were completed in March, compared to seven the month prior. Preqin did not provide total dollar amounts for the deals.

Commercial real estate research firm Real Capital Analytics on Thursday also reported drops in commercial real estate investment activity. By dollar amount, deal volume for transactions $10 million or higher dipped 1 percent for the Americas for the first 13 weeks of 2020 compared to last year. In Europe, the Middle East and Africa, volume was 18 percent lower; and in Asia, it was down 56 percent.

But it’s likely that the worst is yet to come.

RCA said the impact of the pandemic is expected to become more evident in the second quarter for the Americas, Europe, the Middle East and Africa because “large-scale shutdowns only began to occur in these regions in early March.” In the post accompanying its findings, RCA added that “transactions are typically in progress for several months before completion.

In New York last week, there were no mid-market investment sales uploaded to city records.

“Anytime there’s uncertainty in the market, if something is not a must sell or a must buy, people are going to take their time and take a step back,” one New York-based broker told The Real Deal at the time. “Because they want to measure twice and cut once.”

Pre-coronavirus, private equity real estate funds were already on pace for a slowdown. Those funds closed $18 billion in the fourth quarter of 2019, the slowest quarter since 2013 and down from $47 billion from the prior quarter.

Write to Mary Diduch at md@therealdeal.com