As the coronavirus pandemic pressures real estate across the country, industry observers are expecting a significant increase in borrowers struggling to make loan payments. Payment delays that would usually be considered minor are suddenly regarded as important. They are certainly much more common.

This week, CMBS data provider Trepp began monitoring CMBS loans that are “late but within grace period” and “late beyond grace period” — marked with the status codes “A” and “B,” respectively, under CRE Finance Council guidelines.

“Historically, the industry has never really had reason to look at this status since these loans were generally considered ‘current,’” Trepp analysts wrote Wednesday. “Now, the data serves as an early indicator of what could become 30 days delinquent a month from now.”

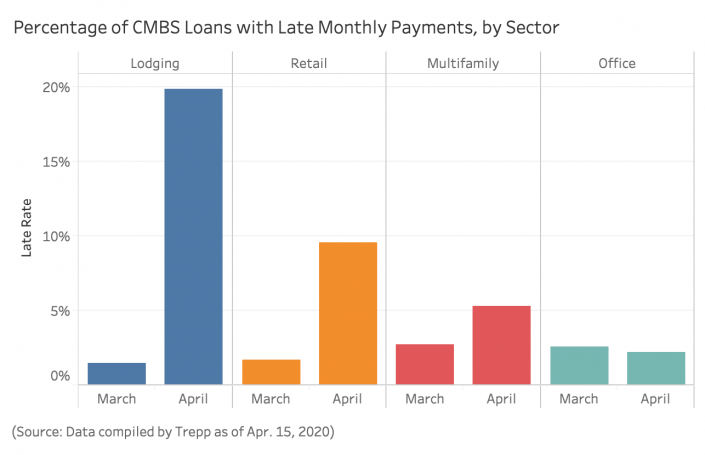

CHART HED: CMBS Loans Marked for Late Payment

| Sector | March Late Rate | April Late Rate |

|---|---|---|

| Lodging | 1.5% | 19.9% |

| Retail | 1.7% | 9.6% |

| Multifamily | 2.7% | 5.3% |

| Office | 2.6% | 2.2% |

SOURCE: Trepp

Unsurprisingly, the data shows that lodging has been hit particularly hard, with about 1 in 5 lodging CMBS loans marked as late on the April payments, up from about 1 in 75 a month before. The late payment rate for retail CMBS has also soared, to 9.6 percent from 1.7 percent. Even the multifamily sector has seen the proportion of late payments nearly double, to 5.3 percent from 2.7 percent.

The exception is office CMBS loan payments, which have a lower lateness rate than last month, for now. But 65 percent of loans have yet to report their status for the month, and Trepp notes that the rate of late payments is likely to change — and probably for the worse.

“Unfortunately, the numbers above could be on the low side of what’s to come,” Trepp analysts wrote Tuesday. “There are many examples of loans for which the April 1 payment was made, but for which the watchlist comments now indicate a forbearance has been requested.”