As the novel coronavirus raced around the world, America and Europe looked at Asia as an indication of what was to come. With the debate here shifting from containment to re-opening, data from Asia show that a return to normalcy may take a while.

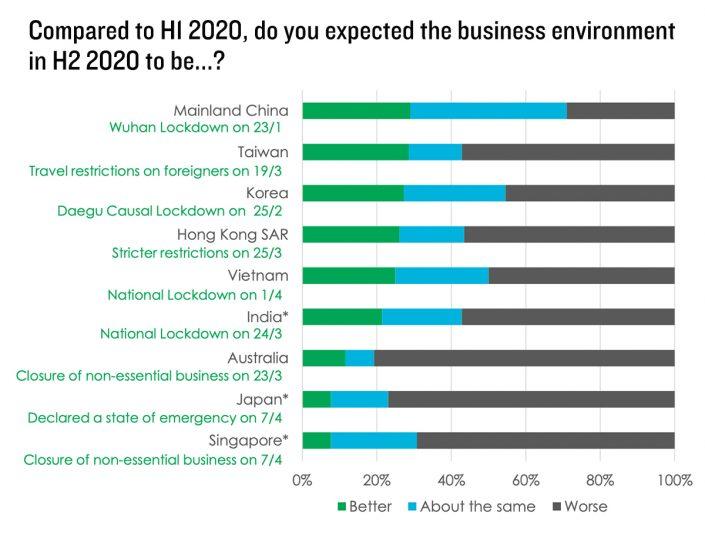

A survey of 264 office occupiers in the Asia-Pacific region, conducted by CBRE in late March and early April, found that a slim majority of respondents (51 percent) expected the business environment to worsen in the second half of the year. Notably, tenants in mainland China — where the virus originated and where the government has begun to cautiously restart the economy — were the most optimistic, with 71 percent expecting things to be at least “about the same” if not better.

Part of the reason may simply be that China had a particularly rough first half: The nation’s GDP contracted 6.8 percent in the first quarter, its first quarterly contraction on record. Meanwhile, in Japan and Singapore, which had apparent success in containing the virus early on, tenants are particularly pessimistic about the latter half of 2020 following recent spikes in Covid-19 cases. And tenants in Australia, where booming trade with China has helped the island nation go 29 years without a recession, were most pessimistic of all.

Covid-19 Responses and Measures

| Response Measures | Mainland China | Asia Pacific |

|---|---|---|

| Remote/home working | 91% | 86% |

| Flexible working hours | 73% | 61% |

| Staff rotation (e.g. Team A & B) | 55% | 45% |

| Split offices to separate key personnel | 20% | 30% |

| Ceased desk-sharing and/or activity-based working (ABW) | 7% | 9% |

| Use of flexible office centres | 2% | 6% |

The coronavirus epidemic has also brought changes in behavior which could have far-reaching consequences for office markets. Notably, 86 percent of respondents reported turning to home and remote work, and large numbers have introduced flexible working hours and staff rotation as well. Meanwhile, only 29 percent reported receiving rent relief from landlords — and only 7 percent were satisfied with their relief (or lack thereof).

Source: CBRE Asia Pacific Research