After the coronavirus crisis put much business activity in the city on ice, Manhattan’s office leasing market saw a 25 percent year-over-year decline in leasing volume in the first quarter of 2020, making it the slowest quarter in seven years. The numbers were striking, and are likely to get worse in the second quarter — but how does the market’s performance compare to previous recessions?

Data from a new report by Colliers International shows that the last two recessions — in 2001 and 2008 — led to quick shocks to the city’s office market, followed by gradual recoveries.

The Great Recession of 2008 saw a greater decline in activity at first — 18.4 percent — although leasing recovered three years later. After the 2001 recession — in which the dot-com crash was compounded with the September 11 terrorist attacks — leasing activity declined 14.1 percent in the first year and took five years to get out of its slump.

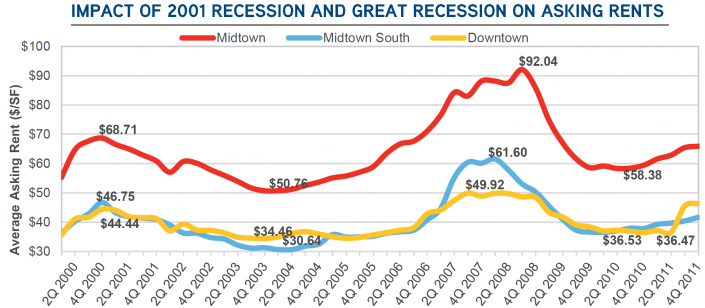

The 2008 recession also saw a sharper decline in asking rents than in 2001. Sublets rose to account for more than 40 percent of all available space in 2001 — twice the usual level.

Manhattan Office Market in Previous Recessions

| Statistic | 2001 Recession | 2008 Recession |

|---|---|---|

| Leasing volume decline in first year | 14.1% | 18.4% |

| Years until leasing activity rebounded | 5 | 3 |

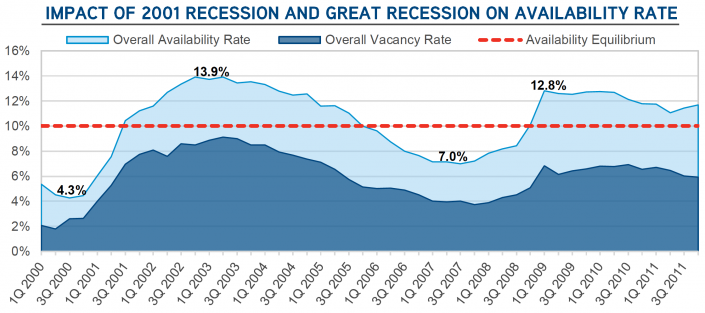

| Years of above-equilibrium (>10%) availability rates | 4 | 6 |

| Max sublet share of total availability (usually around 20%) | 41.5% | 26.7% |

| Asking rent decline from peak to trough | 27.9% | 35.1% |

SOURCE: Colliers International Research

The Manhattan office market of 2020, pre-coronavirus, was very different from the markets of prior recession thanks to the rise of tech tenants and new supply in submarkets like Midtown South and Hudson Yards, among other factors.

While the availability rate in Manhattan was a remarkably low 4.3 percent in 2000, and 7 percent in 2007, that figure has rarely dipped far below 10 percent — considered to be the “equilibrium point” between supply and demand — in the current cycle. Meanwhile, asking rents in Downtown and Midtown South are breaking new records while Midtown remains a far cry from where it was in 2008, when asking rents averaged $92.04.