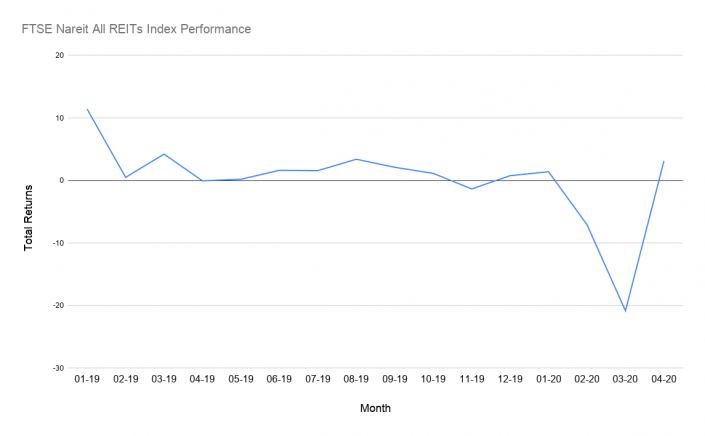

Real estate investment trusts appear to be turning a corner, after recording strikingly low monthly total returns for March.

So far in April, the FTSE Nareit All REITs index, which follows all public REITs, is tracking returns of 3.1 percent, according to data from Nareit, an industry group. However, returns are trending down for the week.

April’s performance to date is up from a 20.9 percent loss the month prior and a 7.1 percent loss in February.

Source: Nareit

March’s performance signified the third-worst month since the tracking of total returns data began in 1972. The worst-performing month was October 2008, when REITs posted a 30.2 percent loss, followed by November 2008, when the loss was 21.5 percent, according to Nareit.

The fallout of REITs amid the Covid-19 pandemic reverses what had been a strong 2019 for the asset class. The index closed out the year with total returns up 28.1 percent, and with only April and November posting negative returns.

FTSE Nareit All REITs Index Total Returns

| FTSE Nareit All REITs Index Total Returns | ||||||

|---|---|---|---|---|---|---|

| Month | Total Returns | |||||

| 01-19 | 11.42 | |||||

| 02-19 | 0.5 | |||||

| 03-19 | 4.22 | |||||

| 04-19 | -0.06 | |||||

| 05-19 | 0.2 | |||||

| 06-19 | 1.63 | |||||

| 07-19 | 1.58 | |||||

| 08-19 | 3.4 | |||||

| 09-19 | 2.11 | |||||

| 10-19 | 1.14 | |||||

| 11-19 | -1.35 | |||||

| 12-19 | 0.77 | |||||

| 01-20 | 1.4 | |||||

| 02-20 | -7.08 | |||||

| 03-20 | -20.85 | |||||

| 04-20 | 3.12 | |||||

To combat the cash crunch amid the coronavirus, many REITs, which have to pay out 90 percent of taxable income to investors, have cut or suspended dividends and drawn down their credit lines.

Write to Mary Diduch at md@therealdeal.com