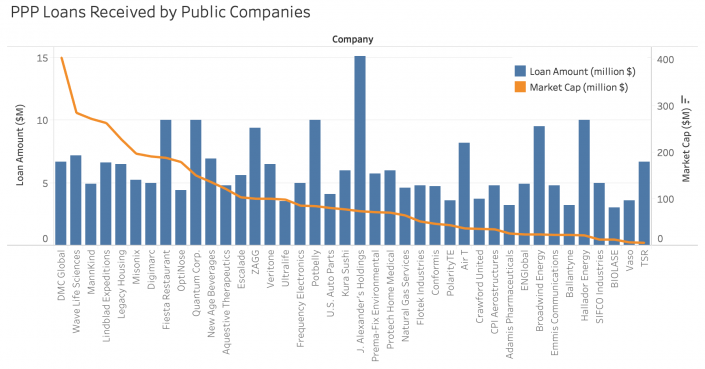

By the time funding for the Paycheck Protection Program ran out last week, hundreds of millions of dollars had gone to publicly traded companies rather than the mom-and-pops the stimulus program was meant to help, CNBC reported.

A research report from Morgan Stanley found that at least $243.4 million went to public companies — several with market capitalizations of more than $100 million. One of them, oil services company DMC Global, had recently laid off a third of its workforce as oil prices collapsed. Wave Life Sciences and Fiesta Restaurant Group also landed loans worth millions of dollars from the Small Business Administration program’s initial batch of funding.

Public Companies Receiving PPP Loans

| Company | Loan Amount (Million $) | Market Cap (Million $) |

|---|---|---|

| DMC Global | 6.7 | 405 |

| Wave Life Sciences | 7.2 | 286 |

| MannKind | 4.9 | 273 |

| Lindblad Expeditions | 6.6 | 264 |

| Legacy Housing | 6.5 | 229 |

| Misonix | 5.2 | 198 |

| Digimarc | 5 | 192 |

| Fiesta Restaurant | 10 | 189 |

| OptiNose | 4.4 | 180 |

| Quantum Corp. | 10 | 151 |

| New Age Beverages | 6.9 | 137 |

| Aquestive Therapeutics | 4.8 | 122 |

| Escalade | 5.6 | 104 |

| ZAGG | 9.4 | 101 |

| Veritone | 6.5 | 101 |

| Ultralife | 3.5 | 99 |

| Frequency Electronics | 5 | 86 |

| Potbelly | 10 | 85 |

| U.S. Auto Parts | 4.1 | 81 |

| Kura Sushi | 6 | 78 |

| J. Alexander's Holdings | 15.1 | 74 |

| Prema-Fix Environmental | 5.7 | 72 |

| Protech Home Medical | 6 | 71 |

| Natural Gas Services | 4.6 | 65 |

| Flotek Industries | 4.8 | 52 |

| Conformis | 4.7 | 47 |

| PolarityTE | 3.6 | 44 |

| Air T | 8.2 | 37 |

| Crawford United | 3.7 | 36 |

| CPI Aerostructures | 4.8 | 35 |

| Adamis Pharmaceuticals | 3.2 | 26 |

| ENGlobal | 4.9 | 24 |

| Broadwind Energy | 9.5 | 24 |

| Emmis Communications | 4.8 | 23 |

| Ballantyne | 3.2 | 23 |

| Hallador Energy | 10 | 22 |

| SIFCO Industries | 5 | 13 |

| BIOLASE | 3 | 13 |

| Vaso | 3.6 | 7 |

| TSR | 6.7 | 6 |

SOURCE: Morgan Stanley, CBS

Though $243.4 million in loans to large companies sounds like a lot, it accounted for less than 0.07 percent of $349 billion in total available funds. Still, the practice has attracted attention and criticism. “I think you’ve seen some pretty shameful acts by some large companies to take advantage of the system,” said Howard Schultz, the former Starbucks chairman and CEO.

According to SBA statistics released last week, about 4,400 of the 1.6 million loans were worth more than $5 million, and the real estate industry received 3 percent of funds disbursed. The size of the typical loan nationally was $206,000.

In New York, reported real estate recipients of PPP loans include Rotem Rosen’s MRR Development ($1.7 million) and Allen Gross’ GFI Capital Resources Group ($12 million). Congress and the White House reached a deal Tuesday to replenish the program with $310 billion.