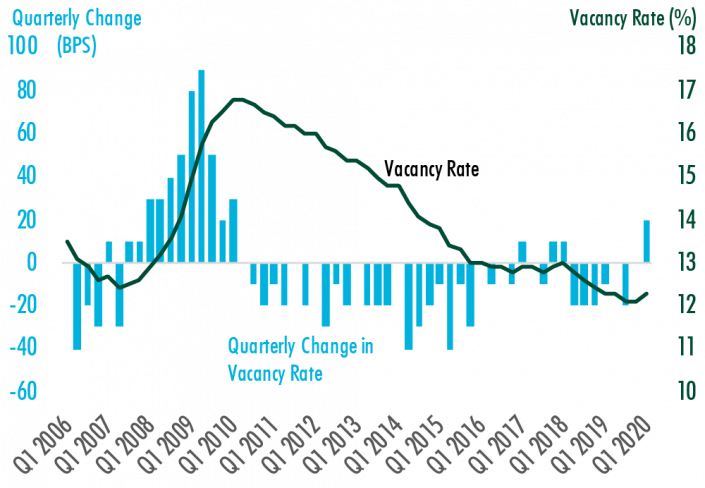

The national office vacancy rate in the first quarter jumped 20 basis points from the previous quarter to 12.3 percent — the largest quarterly increase in a decade, according to a CBRE MarketFlash report.

At least some part of this increase in the vacancy rate was anticipated before the coronavirus pandemic hit the United States: CBRE economists had predicted a 10-basis-point increase because of slowing demand and rising supply.

Office Vacancy Rate by Quarter

Vacancy rates for office space have also increased less steeply than in other sectors such as hospitality, thanks in part to relatively limited losses of professional and business-services jobs.

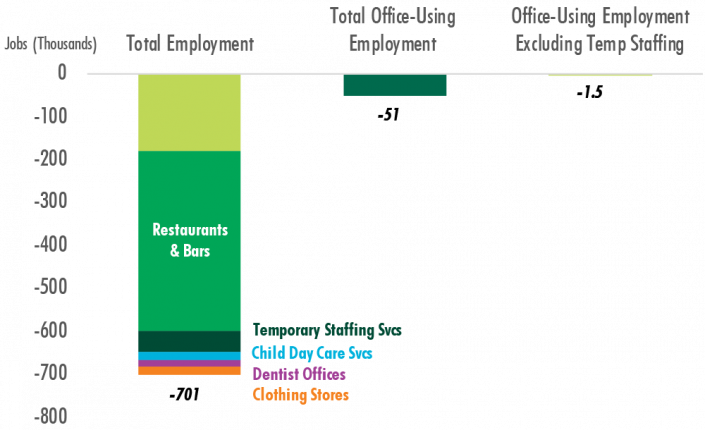

Data from the Bureau of Labor Statistics’ March jobs report shows that business-services and professional employment declined by 52,000 in March 2020, and 50,000 of those were temp jobs. Of the 701,000 job losses reported in March, 459,000 were in leisure in hospitality, and 91 percent of those were at restaurants and bars.

Job losses by industry in March 2020

Unemployment insurance claims have surged in the last few weeks, and it’s likely office job losses will continue to mount in the coming weeks. The report’s authors note that the next month will be an important temperature check on office users’ adjustment to working from home and their vulnerability to Covid-19.