With the coronavirus pandemic putting health and sanitation in the spotlight, co-working companies are being squeezed by both tenants and landlords, while the very concept of dense, collaborative offices has come into question.

Co-working firms have begun seeking rent relief, pulling out of leases and laying off staff to cut costs. It seems likely that when the crisis is over, co-working firms will occupy less office space in New York City than they do now. And some neighborhoods will be more affected than others.

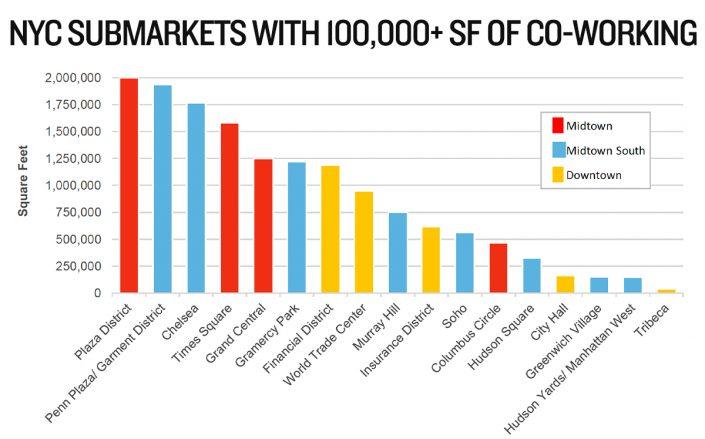

The 11 largest co-working firms in Manhattan — each of which occupies more than 100,000 square feet — have a total footprint of about 15 million square feet, according to a recent report from Colliers International. That’s about 3 percent of all office space on the island.

Midtown South, a hotbed of tech and media tenants, has the most co-working space among the three main submarkets, with 6.86 million square feet, followed by Midtown with 5.29 million and Downtown with 2.95 million. At a more granular level, the most co-working-laden submarket is Midtown’s Plaza District, followed by the Garment District/Penn Plaza and Chelsea, both in Midtown South.

SOURCE: Colliers International

“Covid-19 has called into question the future of coworking’s shared amenities, close working quarters and bench-style seating that is so strongly associated with the industry,” the report says. “Each coworking firm has its own business model and is facing the challenges brought on by the Covid-19 pandemic in its own unique way.”

But Colliers does not think co-working will go kaput.

“It is unlikely that demand for coworking space completely vanishes once this pandemic ends,” the report said.