The number of mortgages in forbearance continues to rise, jumping more than 1 percentage point last week, according to data from the Mortgage Bankers Association.

And that figure is likely to keep rising, according to MBA, which represents the real estate finance industry. MBA’s data represents 77 percent of the first-mortgage servicing market, or 38.3 million loans.

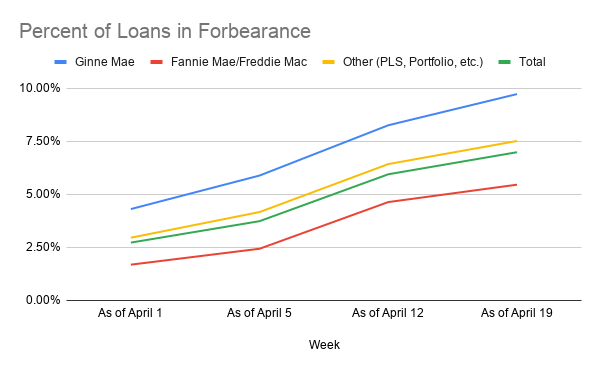

As of April 19, 6.99 percent of mortgage servicers’ loans were in forbearance, an agreement made between lenders and borrowers meant to stave off foreclosure. That was up from 5.95 percent the week before, MBA said. To gauge the impact the coronavirus shutdown has had, just 0.25 percent of loans were in forbearance the week of March 2.

The percentage of mortgages in forbearance has steadily increased since at least April 1 across all loan types, MBA’s data shows.

The share of Ginnie Mae loans in forbearance grew the most among investor types from the week before, the MBA noted. The amount of those mortgages in forbearance rose to 9.73 percent from 8.26 percent. Meanwhile, 5.46 percent of Fannie Mae and Freddie Mac loans are also now in forbearance, up from 4.64 percent the week before.

Percent Loans in Forbearance

TABLEPRESS CODE:

| Investor Type | As of April 1 | As of April 5 | As of April 12 | As of April 19 |

|---|---|---|---|---|

| Ginne Mae | 4.31% | 5.89% | 8.26% | 9.73% |

| Fannie Mae/Freddie Mac | 1.69% | 2.44% | 4.64% | 5.46% |

| Other (PLS, Portfolio, etc.) | 2.96% | 4.17% | 6.43% | 7.52% |

| Total | 2.73% | 3.74% | 5.95% | 6.99% |

SOURCE: Mortgage Bankers Association

Servicers also are getting more calls but fewer requests for help to postpone mortgage payments. Servicers received calls from 10 percent of their portfolio, according to MBA. That’s up from 8.8 percent the prior week. However, the number of requests for forbearance dropped to 1.14 percent of servicers’ portfolio, from 1.79 percent over the same time frame.

“While the pace of job losses have slowed from the astronomical heights of just a few weeks ago, millions of people continue to file for unemployment,” MBA senior vice president and chief economist Mike Fratantoni said in a statement. “We expect forbearance requests will pick up again as we approach May payment due dates.”

Write to Mary Diduch at md@therealdeal.com