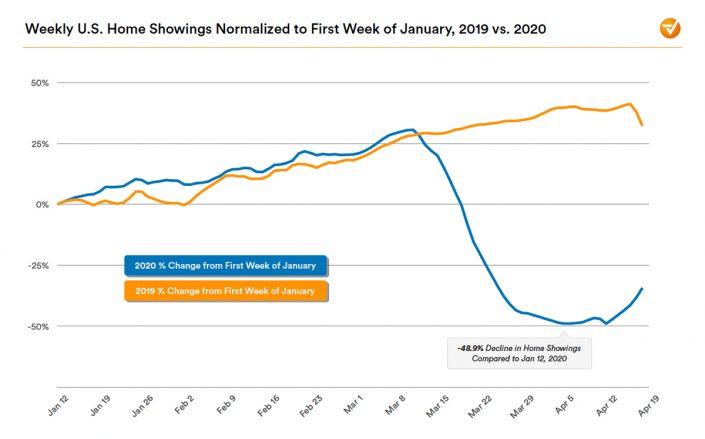

Social distancing and shelter-in-place orders across the country have complicated home showings and discouraged new listings. Two charts in a new report from venture capital firm Thomvest Ventures show just how dramatic the dropoff has been.

The first graphic compares home showings in the early months of this year with the corresponding periods from 2019. It shows the first nine weeks of 2020 as unremarkable — by early March, the number of weekly showings was more than 25 percent higher than at the start of the year, much like in 2019. As the full force of the coronavirus hit and states responded, home showings fell by half.

Source: ShowingTime

The last two weeks has seen a slight uptick, as the real estate industry has begun to adjust, with increasing numbers of virtual home showings. “The initial drop in showing activity … has given way to modest signs of stabilization,” report author Nima Wedlake wrote.

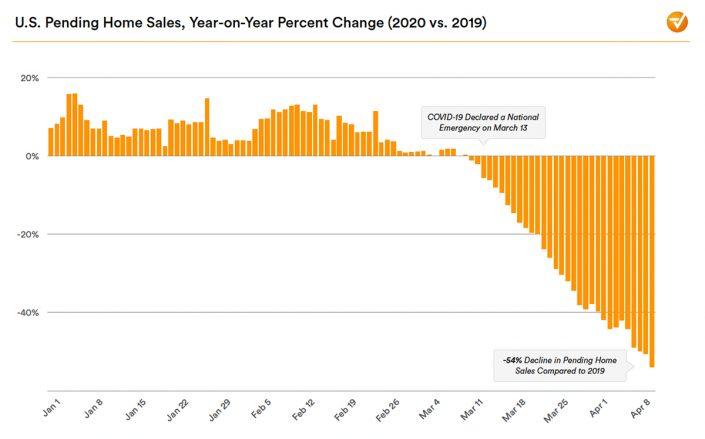

In the second graphic, pending home sales in the U.S. started the year slightly outpacing the same period in 2019. That came to a halt soon after the virus was declared a national emergency in mid-March. Pending sales are now down 54 percent year-over-year.

“The number of fresh listings typically grows by about 50% from March 1 to early April, but this year fell 19% as the COVID-19 pandemic worsened,” Wedlake wrote.

Source: RedFin; Data shown as 7-day rolling average