Trending

TRD Insights: US housing market was better prepared for this recession: Report

Fewer homeowners have risky mortgages, but unemployment is skyrocketing

While risks in the home mortgage market contributed to the Great Recession a dozen years ago, the current economic crisis has been caused by an entirely unrelated factor. Sure enough, mortgage data from earlier this year shows that the market was in a much better place than before 2008.

Numbers compiled by venture capital firm Thomvest Ventures for a new report (which also showed large drop-offs in showing and pending sales since March) illustrate the many ways in which the mortgage market was better protected from a downturn — to a point.

“Today’s homeowners are in stronger equity positions relative to 2007 — fewer have mortgages and those that do have a lower loan-to-value ratio,” author Nima Wedlake wrote. There are also far fewer adjustable rate mortgages and subprime loans, products which wreaked havoc during the Great Recession.

Indicators of Mortgage Borrower Credit Quality, 2007 vs. 2020

| Metric | Great Recession (Entering 2007) | COVID-19 (February 2020) |

|---|---|---|

| Percent of Homeowners w/ a Mortgage | 68.40% | 62.90% |

| Number of Active Mortgages | 53.7M | 52.9M |

| Percent of Homeowners w/ Less Than 10% Equity | 14.50% | 6.60% |

| Total Market Combined Loan-To-Value Ratio | 57.40% | 52.30% |

| Average Current Combined Loan-To-Value Ratio | 61.80% | 53.30% |

| Average Debt-to-Income Ratio at Origination | 34.5 | 33.5 |

| Average Original Credit Score | 708 | 736 |

| Average Current Credit Score | 713 | 747 |

| Mortgage Delinquency Rate | 4.92% | 3.28% |

| Payment-to-Income Ratio | 31.80% | 20.90% |

| Number of Active Subprime Loans | 5.1M | 1.98M |

| Number of Active Adjustable-Rate Mortgages | 12.89M | 3.2M |

| Adjustable-Rate Mortgages Resetting within 3 Years | 4.95M | 320K |

| Ginnie Mae/Government-Sponsored Enterprise Share | 63% | 75% |

SOURCE: Black Knight & Urban Institute

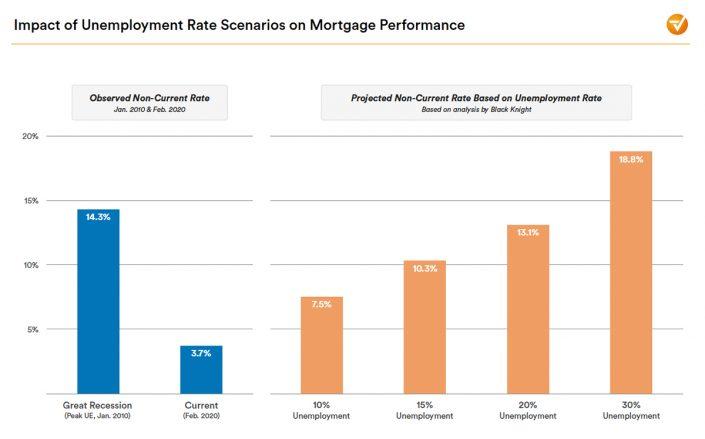

But another way in which the current crisis differs from 2008 is the sharp increase in unemployment claims. Total unemployment claims have already ballooned to 30 million since mid-March. “A sustained period of unemployment may impact borrowers’ ability to make mortgage payments,” writes Wedlake.

The accompanying chart, based on an analysis from mortgage data firm Black Knight, projects that a greater percentage will become non-current in this downturn than during the Great Recession if unemployment reaches 30 percent — a distinct possibility, according to officials.

Source: Black Knight