The high-end residential market has shriveled more than any other during the coronavirus pandemic.

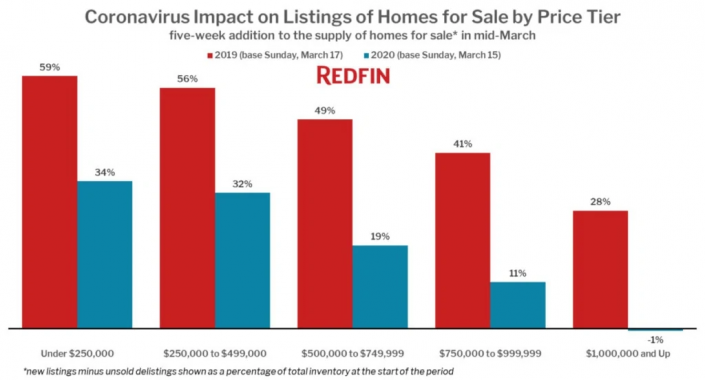

In the five weeks beginning March 15, more $1 million-and-up homes were pulled off the market than were listed, according to an analysis of listing activity from online real estate brokerage Redfin.

It was a dramatic difference from the same period last year, when new listings of homes with seven-figure price tags made up 28 percent of the high-end market, after delistings of unsold homes were subtracted. The flood of delistings this spring drove that figure into negative territory.

Taylor Marr, Redfin’s lead economist, said this drop in supply is likely attributable to tighter credit for big home loans and tempestuous economic and market conditions.

As a result, metro areas with expensive homes experienced the most severe declines in the percentage of home listings that were new. San Francisco and San Jose — think Silicon Valley — and Boston, which also has a bustling tech sector, each saw new supply drop by at least 50 percentage points from the same five weeks last year. Only two of the 50 largest metros had increases in new listings’ share of the market: Salt Lake City and Phoenix.

Supply shortfalls haven’t exclusively affected the high-end market, though. The supply of homes listed for $250,000 and below, minus unsold homes delisted, were 34 percent of total inventory this year, down from 59 percent last year. This shortfall exacerbates an existing nationwide shortage of affordable homes.

In California, many residential brokers anticipated deferred lease payments, price cuts and delistings after Gov. Gavin Newsom issued a statewide stay-at-home order in March to curb the spread of the coronavirus — a policy soon adopted by much of the rest of the country. In some cities, mayors have allowed brokers to resume in-person viewings after a month of video tours and virtual showings.