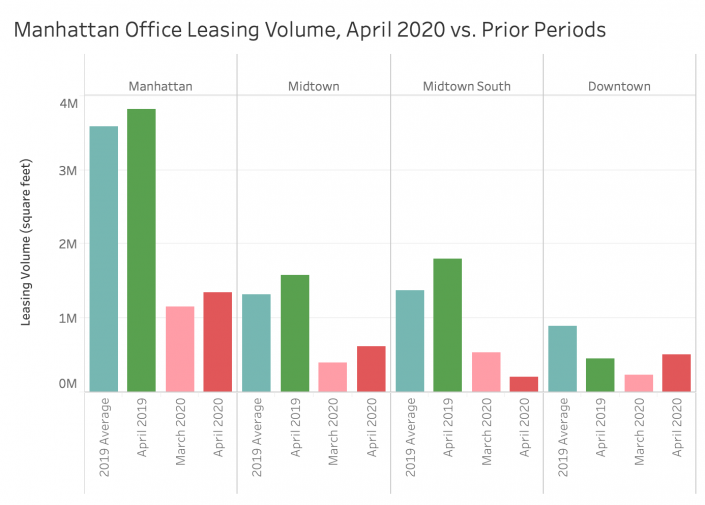

Manhattan’s office leasing market responded quickly and sharply to the coronavirus crisis in March, dragging the quarter’s total volume to a seven-year low. April’s numbers, meanwhile, show the slightest of rebounds — although leasing volume remains far below historical levels.

Monthly leasing activity on the island rose 15.9 percent in April compared to March, totalling 1.35 million square feet, according to research from Colliers International. This was driven by a 54.4 percent increase in Midtown and a 122 percent increase Downtown, but offset by a 59.8 percent decline in Midtown South — a submarket which has now seen leasing volume drop for five straight months, since Facebook signed its huge Hudson Yards lease in November.

But as the below chart shows, these modest gains are nothing compared to where the market was a year ago — about three times as active as they are now. The burgeoning Downtown submarket did comparatively well, and was actually slightly up year-over-year, but still well below 2019’s monthly average.

Office Leasing Activity in Manhattan, by Month and Market

| Market | April 2020 | March 2020 | April 2019 | 2019 Monthly Average |

|---|---|---|---|---|

| Manhattan | 1,350,000 | 1,160,000 | 3,820,000 | 3,580,000 |

| Midtown | 620,000 | 400,000 | 1,580,000 | 1,320,000 |

| Midtown South | 210,000 | 530,000 | 1,800,000 | 1,370,000 |

| Downtown | 510,000 | 230,000 | 450,000 | 890,000 |

Source: Colliers International Research