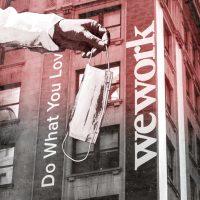

WeWork’s efforts to renegotiate several of its leases and skip rent payments is causing the price of bonds backed by payments from the company to plummet.

Many WeWork tenants have requested rent relief or the termination of their contracts since the onset of the coronavirus pandemic, which has hurt the commercial mortgage-backed securities that rely on rent from WeWork to pay investors, according to the Financial Times.

Overall, about $5.5 billion worth of CMBS deals include properties that count WeWork as a tenant, according to data from Trepp. These include some of the company’s flagship locations in New York and San Francisco. A $240 million loan backed by a WeWork location in San Francisco is now trading at 73 cents on the dollar, down from 100 cents in March.

With a short-term lease model, WeWork is more at risk of increasing vacancies than standard office buildings. This puts more pressure on WeWork itself to keep up with rental payments — and even when lockdown measures are rolled back, whether or not WeWork’s tenants will return remains unclear.

Read more

Some tenants have complained that it has been extremely difficult to cancel their WeWork lease or freeze their rent payments, and the company’s efforts to keep its locations open during the pandemic have been controversial. A group of WeWork members is threatening to sue the company if it continues to collect fees from them despite the pandemic preventing them from using their space.

Michelle Orman, a WeWork tenant in Brooklyn, said to the Financial Times that she is not going to renew her lease after May and had tried to cancel it sooner. She has “no intention of going back to [WeWork] after this experience.”

“I can’t support a business that turns its back on entrepreneurs and small businesses,” she said. [FT] – Eddie Small