Residential development in downtowns has accelerated over the last 30 years, in part to meet demand from decamping suburbanites attracted to better amenities and proximity to jobs. Yet the defining quality of downtowns — high population density — places them at higher risk of becoming hotspots for infectious disease.

Could the coronavirus pandemic reverse the decades-long trend of population growth and investment in downtowns? It’s not likely, according to a recent report from the Brookings Institution, a nonpartisan centrist Washington-based think tank.

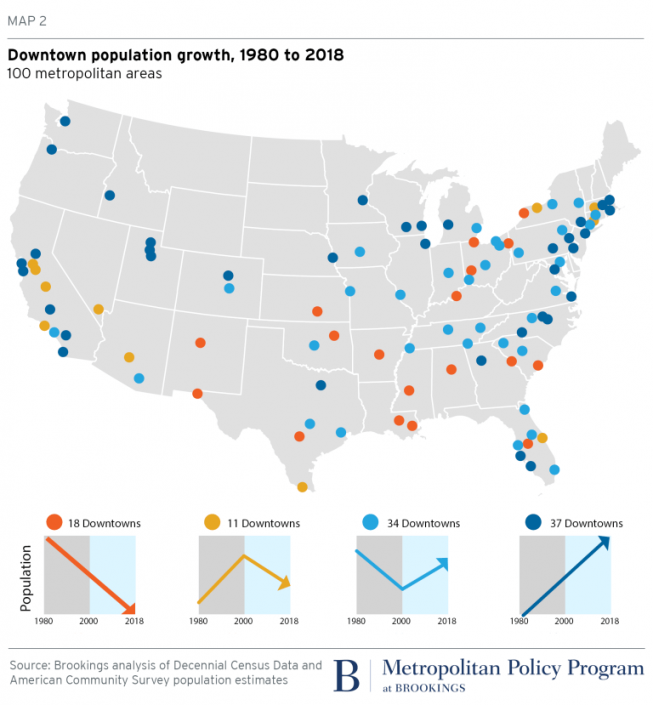

Brookings researchers examined the populations of central business districts and surrounding neighborhoods in cities with more than 500,000 residents over time.

Broadly, they found that downtowns in metro areas with more than 1 million residents gained the most momentum in the 1990s and have sustained that momentum through the 2010s. In Chicago, for example, the downtown population ballooned from about 18,000 in 1980 to more than 110,000 in 2018, even though the surrounding area has lost population since the turn of the century.

The report’s authors don’t anticipate a drop in migration to downtowns because of the pandemic. “While diseases will come and go, we can always retrofit our cities to make us feel safe while still delivering the proximity we crave,” they write.

In fact, the researchers say these long-term trends signal that real estate markets and city governments should more actively pursue downtown development to meet demand.

The authors suggest that demand for new real estate might outpace new supply, incentivizing adaptive reuse of office buildings. Some real estate experts anticipate a growth in the popularity of office-to-residential conversions as companies learn they can work from home without major hits to productivity.

The Brookings Institution researchers’ optimism is far from universal. Sam Chandan, dean of the Schack Institute of Real Estate, told The Real Deal that density might fall out of favor given the pandemic, presenting a major challenge to downtowns nationwide.