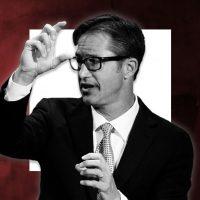

Rich Barton is walking the talk.

Days after the CEO declared during a rosy earnings call that “we have passed peak fear,” Zillow Group filed a prospectus seeking to sell up to $1 billion in stock and convertible senior notes.

The company is offering up to 9.2 million shares of its Class C capital stock at a public offering price of $48 per share. At the same time it is also selling $500 million in convertible senior notes due in 2025 at an interest rate of 2.75 percent, a pricing term sheet shows. If all options are fully exercised, the company expects to raise up to $1 billion in gross proceeds.

In filings, the company said it expects to put the funds toward the cost of repurchasing a portion of senior convertible notes due in 2021. The deal will be privately negotiated but Zillow expects to pay $196.4 million in cash and issue close to 754,000 shares of Class C stock.

The rest of the funds will be put toward general corporate purposes and, potentially, an acquisition spree.

“[Zillow] may choose to expand our current business through acquisitions of, or investments in, other businesses, products or technologies, using cash or shares of our common stock or capital stock,” the prospectus reads.

The company noted, however, that there are no current agreements or commitments in place.

Read more

The company’s filings for the stock and debt offerings became public on Tuesday.

In the first day of trading, Zillow’s Class C capital stock [Z] and Class A common stock [ZG] plunged 12 percent to $49.22 per share and $48.52, respectively. The slide continued Wednesday with both stocks closing down 16 percent from Monday’s closing price at $46.53 [Z] and $46.25 [ZG].

Zillow reported ending the first quarter of 2020 with $2.6 billion of cash and investments, the highest in its history, and announced it would resume its iBuying business, which was halted in mid-March. Shortly after, the company responded to the growing pandemic by slashing 25 percent of its expenses.

Write to Erin Hudson at ekh@therealdeal.com