The country’s largest shopping mall has reportedly fallen behind on its $1.4 billion mortgage, posing a threat to the wider bond market.

The Mall of America in Minnesota, which features more than 500 stores across 2 million square feet, missed mortgage payments in both April and May, according to the Financial Times.

The mall has been shut since March because of the pandemic, and has reportedly notified its mortgage servicer, Wells Fargo, about hardship stemming from the closure.

Read more

Retailers across the country have been hit hard by the pandemic, which has led to mass store closures and layoffs. Earlier this month, Neiman Marcus, the anchor tenant at Related Companies’ luxury Hudson Yards mall, filed for bankruptcy. J. C. Penny, another major department store chain, filed for bankruptcy last week.

The pressure on retailers has implications for the commercial mortgage-backed securities market, which distributes loans through bonds.

The FT reports that upward of one in five loans bundled into commercial mortgage-backed securities are currently on “watch lists” that are recorded by mortgage-servicing companies.

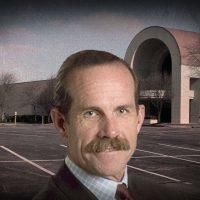

Last month, Don Ghermezian of Triple Five Group — owner of Mall of America — said in an interview that “many malls will be headed into default” if they can’t secure federal assistance.

The mall is set to reopen in June. [FT] — Sylvia Varnham O’Regan