The U.K.’s billionaire Reuben brothers have snapped up another Manhattan real estate bargain.

The investors bought a $100 million piece of a construction loan SL Green Realty made to the developers of a Gramercy Square condominium development, sources told The Real Deal. The purchase price was a discount of somewhere between 96 and 97 cents on the dollar, according to a source.

A spokesperson for SL Green declined to comment, and a representative the Reuben brothers could not be immediately reached. Eastdil Secured marketed the loan for SL Green. The brokers did not respond to a request for comment.

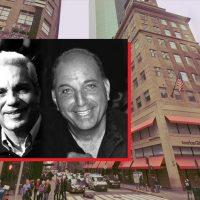

The $100 million is the remaining piece of a $380 million loan SL Green provided developers Joseph Chetrit and David Bistricer’s Clipper Equity in 2018 for their 233-unit condo project on the site of the former Cabrini Medical Center on East 20th Street.

SL Green had previously sold other pieces of the loan off, and is now believed to be completely out of the deal.

This is the second deal between the Reuben brothers and SL Green as the former shops for bargains and the latter looks to shore up its balance sheet.

Brothers David and Simon Reuben last month struck a deal to buy a retail condo on Fifth Avenue for about $170 million from SL Green, which has been selling assets for a discount as it raises a $1 billion war chest.

Contact Rich Bockmann at rb@therealdeal.com or 908-415-5229.

Read more