The number of homeowners seeking forbearance for their mortgages has risen dramatically as a result of the coronavirus crisis, with the Mortgage Bankers Association finding more than 8 percent of home loans to be in forbearance as of mid-May. But what kinds of homeowners have been seeking relief on their loans?

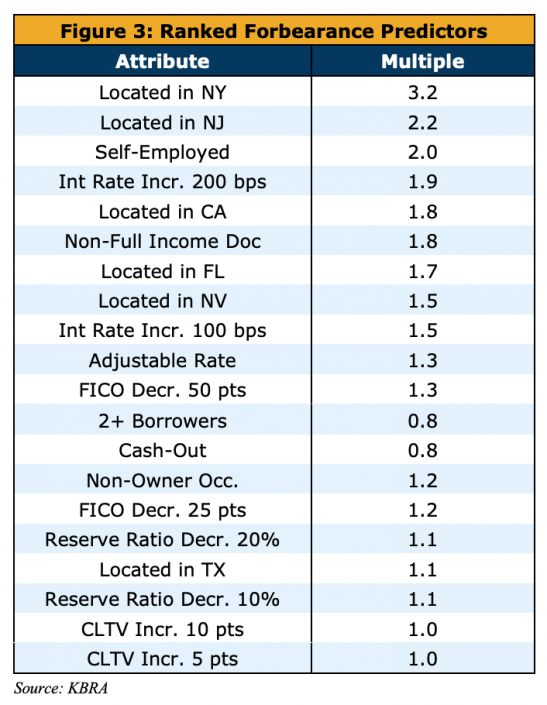

A recent analysis by Kroll Bond Rating Agency provides some clues. The company ran a logistic regression analysis on about 22,000 mortgages across 47 residential mortgage-backed security transactions. It took into account attributes such as geography, interest rate, credit score and employment status to determine which factors had the greatest impact on the likelihood of forbearance requests.

The analysis found that geography plays a key role in determining which homeowners are more likely to request and accept a forbearance plan. A homeowner in New York was found to be three times as likely to have a mortgage in forbearance compared to an average “benchmark” borrower. That would be a wage earner in an owner-occupied property with a decent but not stellar credit score of 750, paying 4.25-percent fixed interest and living outside of California, New York, Florida, New Jersey, Texas, or Nevada.

New Jersey residents were also found to have significantly higher rates of forbearance, at 2.2 times the benchmark rate. Another key factor was being self-employed, which was found to double the probability of seeking and accepting a forbearance plan. Higher interest rates, having incomplete income documentation, or living in California also boosted the likelihood of forbearance, while credit score and cash reserves played a more minor role.

Because of the relatively small sample size of loans collected over a single month — April — Kroll’s report notes that “we believe these results are best viewed as informational indications of rank ordering and the direction (positive or negative) of effects and not as precise predictive measures.”