A spike in mortgage forbearance requests could cause a liquidity crunch for mortgage companies, which is why the metric is regularly forecast. Yet the way forbearance rates are predicted might be all wrong, according to a report from the Urban Institute.

The main measure that housing market analysts use to predict forbearance requests is unemployment. But the report questions the relationship between unemployment and forbearance, and suggests that an unanticipated spike in forbearance requests would deal a major blow to liquidity for mortgage originators and servicers and result in even tighter credit standards for prospective homebuyers.

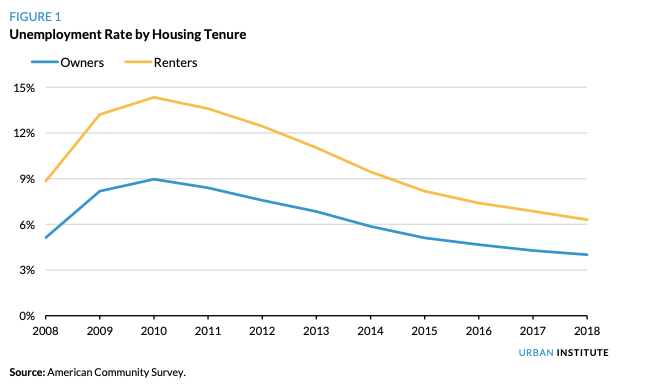

A first step in righting forbearance forecasts is using the homeowner unemployment rate instead of the general unemployment rate, the report recommends. Homeowner unemployment is generally lower than renter unemployment — and the gap might be widening because renter employment is concentrated in sectors that have been kneecapped by the pandemic, such as retail and hospitality.

Still, for a variety of reasons, the forbearance rate might not correlate well with unemployment. The report outlines two scenarios that would skew the numbers in opposite directions:

THE FORBEARANCE RATE MIGHT BE HIGHER THAN THE HOMEOWNER UNEMPLOYMENT RATE

Many homeowners faced money problems before the coronavirus pandemic and will probably request forbearance through the CARES Act — the massive federal relief package — even if they haven’t lost their jobs. In 2019, only 37 percent of Federal Housing Administration 90-day delinquencies were based on job loss or other drops in income. This might push the forbearance rate north of the homeowner unemployment rate.

The unemployment rate also doesn’t capture homeowners who had their hours cut but didn’t lose their jobs. Most states don’t offer unemployment assistance to those that have only lost hours. Many homeowners who lost hourly pay will seek forbearance.

Finally, the CARES Act doesn’t require homeowners seeking forbearance to provide evidence of financial hardship. This, the researchers write, creates a moral hazard: Homeowners who anticipate losing their job soon will seek mortgage relief offered by the CARES Act even if they are still employed because there’s no penalty for doing so.

THE FORBEARANCE RATE MIGHT BE LOWER THAN THE HOMEOWNER UNEMPLOYMENT RATE

Homeowners’ financial profiles differ from renters in key ways. For one, homeowners tend to earn and save more. Census data show that the median family income of homeowners with a mortgage was $93,000 in 2018, but only $55,000 for homeowners without a mortgage and $41,000 for renters.

Homeowners with mortgages can tap into savings and take out home equity lines of credit to continue making mortgage payments instead of requesting forbearance. This, coupled with boosted unemployment benefits and other relief disbursed through the CARES Act, might make it possible for unemployed homeowners to pay their mortgages.

The unemployment rate also doesn’t account for dual incomes. Homeowners are more likely to be married than renters, so even when one household member loses a job, the other’s income can help sustain mortgage payments.

So far, the data appear to support the second scenario more than the first. Data from the Mortgage Bankers Association has shown that forbearances have leveled out despite the spike in unemployment last month.