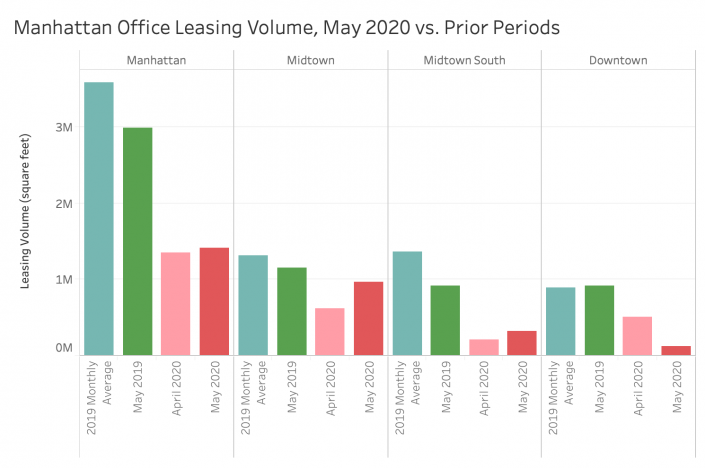

Manhattan’s office leasing market last month continued to slowly rebound from a brutal March, though leasing volume was still less than half of historical levels.

Leasing activity across the borough’s main office markets totaled 1.42 million square feet, up 5.2 percent from April but less than half the amount seen a year before, according to research from Colliers International.

Leasing activity varied significantly by submarket. Midtown’s volume of 970,000 square feet was in the ballpark of pre-coronavirus figures, as the month’s top three deals all occurred in that part of Manhattan. Video-sharing app TikTok led the way with a 232,000-square-foot lease at the Durst Organization’s One Five One, followed by a pair of six-digit lease renewals from law firm Allen & Overy and Japan’s Mitsubishi International.

Meanwhile, Midtown South saw leasing activity rise 50 percent from April to 320,000 square feet, still well below historical levels, and Downtown leasing volume crashed, falling by 75 percent to just 130,000 square feet.

Although widespread adoption of work-from-home arrangements has led industry insiders to predict an uptick in sublet space, that has yet to materialize. Manhattan’s sublet availability rate actually shrunk slightly to 2.2 percent, while overall availability held still at 10.3 percent and asking rents dipped to $79.24.

Office Leasing Activity in Manhattan, by Month and Market (May 2020)

| Market | May 2020 | April 2020 | May 2019 | 2019 Monthly Average |

|---|---|---|---|---|

| Manhattan | 1,420,000 | 1,350,000 | 2,990,000 | 3,580,000 |

| Midtown | 970,000 | 620,000 | 1,150,000 | 1,320,000 |

| Midtown South | 320,000 | 210,000 | 920,000 | 1,370,000 |

| Downtown | 130,000 | 510,000 | 920,000 | 890,000 |

SOURCE: Colliers International Research