Ceruzzi Properties’ Arthur Hooper and the Lipstick Building at 885 Third Avenue(Google Maps; Hooper by Sasha Maslov)

The coronavirus-fueled economic fallout has pushed countless hotel and retail property loans into special servicing. But one of the latest CMBS loans to run into trouble is from a different asset class altogether — the ground underneath a famed Midtown East office building.

The $272 million CMBS loan on the ground under the Lipstick Building at 885 Third Avenue has been transferred to special servicing, according to Trepp data. The reason is listed as “Imminent Monetary Default.” The borrower, Ceruzzi Properties, missed June’s payment; the loan had been paid through May 1.

Special servicer commentary on the deal indicates that the ground lease tenant — a partnership led by Argentina’s Inversiones y Representaciones Sociedad Anónima, or IRSA — defaulted on last month’s rent payment. “The borrower has expressed a need for relief, which was referred to the Special Servicer,” the commentary notes.

According to a lawsuit filed by a subtenant at the property last month — which has since been discontinued — Ceruzzi had sent a notice of default to IRSA on May 15. The annual base rent for the ground lease was about $18 million in 2017, and was subject to a potential “fair market value” reset on May 1, according to loan documents.

The debt-service coverage ratio for the ground lease was 2.0 in 2019, according to Trepp, indicating a rather solid financial position.

Representatives for Ceruzzi declined to comment.

In September, The Real Deal reported that Ceruzzi was seeking to sell the ground underneath the 592,000-square-foot office building after IRSA allowed an option to buy the ground underneath the 34-story tower to expire.

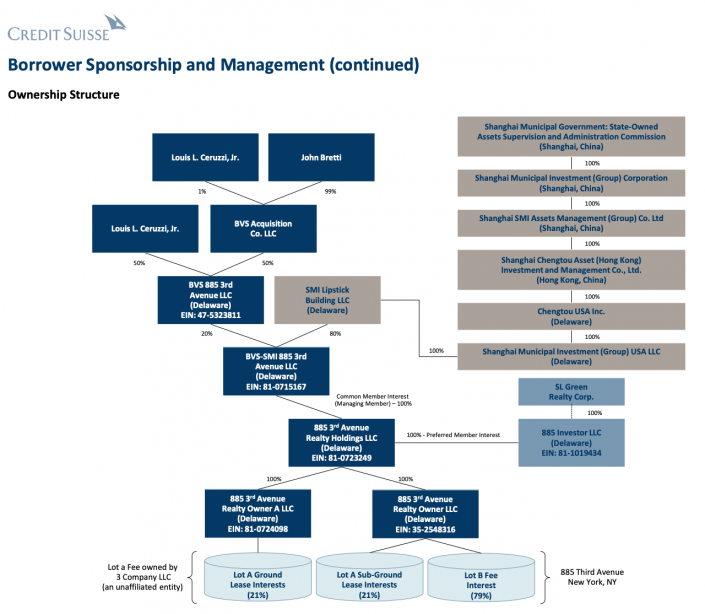

Ceruzzi and partners secured the financing for the fee and leasehold interests in the property in 2017, and the loan was packaged into a single-asset, single-borrower CMBS deal known as CSMC Trust 2017-LSTK. The developer owns about 78.9 percent of the ground outright, and the remainder in the form of a “sandwich” ground lease with another land owner.

Alongside Ceruzzi, Shanghai Municipal Investment owns an 80-percent stake in the borrowing entity, according to loan documents. SL Green also holds a preferred equity interest in the ground lease.

Read more