Forbearance requests inched up only seven basis points for the week ending June 1, marking another period of relative stability in the mortgage market, according to figures released by the Mortgage Bankers Association.

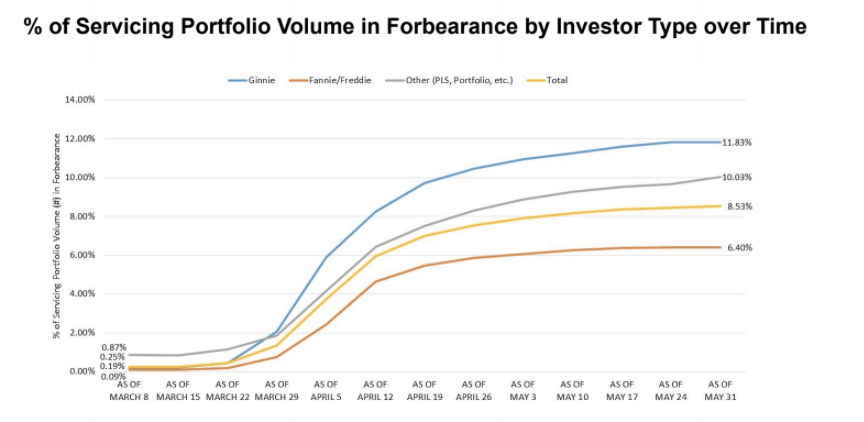

Mortgages in forbearance made up 8.53 percent of servicers’ portfolios for the week, up from 8.46 percent for the week ending May 24 and from 8.4 percent for the week before. Roughly 4.3 million homeowners are now in forbearance.

By investor type, forbearance share for private label securities and portfolio loans grew the most, increasing to 10 percent from 9.7 percent the week prior. Forbearance rates were highest for Ginnie Mae-backed mortgages at 12 percent. Only 6.4 percent of Fannie Mae and Freddie Mac loans were in forbearance.

The first week of June continued the trend of slowing forbearance requests. Such requests dropped for the eighth consecutive week to 0.17 percent of servicing portfolio volume. The week prior, forbearance requests accounted for 0.2 percent of volume.

“With the job market beginning to gradually improve, more homeowners are exiting forbearance, and we are seeing declines in forbearance volume among some servicers,” MBA chief economist Mike Fratantoni said in prepared remarks.

Fratantoni added that loans in forbearance as a share of servicing portfolio volume diverged substantially by servicer type. The share of loans grew again for depository servicers but dropped for independent mortgage banks.

Source: Mortgage Bankers Association