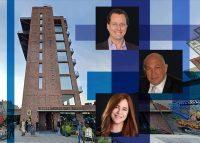

After months of legal wrangling and allegations of collusion and predatory lending, Heritage Equity Partners will lose control of its office development at 215 Moore Street in Bushwick.

Judge Leon Ruchelsman has granted lender Fortress Investment Group’s motion to appoint a receiver for the property, which is subject to a defaulted $32.6 million mortgage. His May 22 decision was disclosed Wednesday.

Read more

Over the past year, Heritage principals Toby Moskovits and Michael Lichtenstein have been coping with a deluge of lawsuits concerning adjacent office and hotel developments at 215 Moore Street and 232 Seigel Street, also known as the Bushwick Generator.

Fortress acquired the mortgage on 215 Moore Street from Axos Bank (formerly Bank of Internet) last May, and filed a lawsuit to foreclose on the property four months later, alleging multiple defaults.

Moskovits, for her part, has called Softbank-owned Fortress a “notorious predatory lender.” In court filings, she alleges that Fortress’ managing director for real estate debt originations and acquisitions, Spencer Garfield, has boasted about plans to “rip out her jugular,” and that Fortress offered an Axos loan officer a job in exchange for participation in its foreclosure “scheme.”

A lawsuit surrounding the adjacent hotel development site, at 232 Seigel Street, is also ongoing. Moskovits and Fortress did not respond to requests for comment on the latest decision.

Ruchelsman noted in his decision that the specific powers of the receiver will be outlined in a separate order. It may be many months before a receiver is actually appointed, as was the case at Heritage’s Williamsburg Hotel.

Moskovits’ chosen candidate was ultimately selected as the receiver for that property, leading to further problems between Heritage and lender Benefit Street which have only been exacerbated by the coronavirus crisis.

Contact Kevin Sun at ks@therealdeal.com