A new research report from Colliers International takes a deep dive into the supply of office space within walking distance of Manhattan’s three major regional transport hubs: Grand Central and Penn stations, and the Port Authority Bus Terminal.

It arrives as New York City approaches Phase 2 of its reopening in the wake of the coronavirus shutdowns, with the subway system emerging as a key concern facing office workers looking to return in the coming months.

The Colliers report notes that suburban commuters to NYC are older on average, and therefore likely to include a larger share of “decision makers and C-suite executives.”

Of the total 526 million square feet in Manhattan’s office market, the report found that about 190 million — or 36 percent — was within a 10-minute walk of Grand Central, Penn and Port Authority.

About 52 percent of Midtown office space is within that 10-minute walk — with Grand Central alone accounting for 42 percent. In Midtown South, the proportion of office space near those hubs is 36 percent, with Penn Station predominating. Zero percent of Downtown office space is within walking distance of any of these three terminals.

Meanwhile, another dynamic likely to emerge in the post-lockdown office market is a preference for modern office space with better air circulation, elevator dispatching systems, and other features that reduce the chance of infection. And the amount of office space that falls into the intersection of “close to a transport hub” and “newly-constructed product” is not all that large.

Colliers found that of the 190 million square feet of office space within walking distance of the three hubs, the vast majority — 80 percent — was built either before World War 2 or in the two decades after it. It also found that just 11 percent was built in this century — notable exceptions like SL Green’s One Vanderbilt or Vornado Realty Trust’s Farley Post Office development notwithstanding.

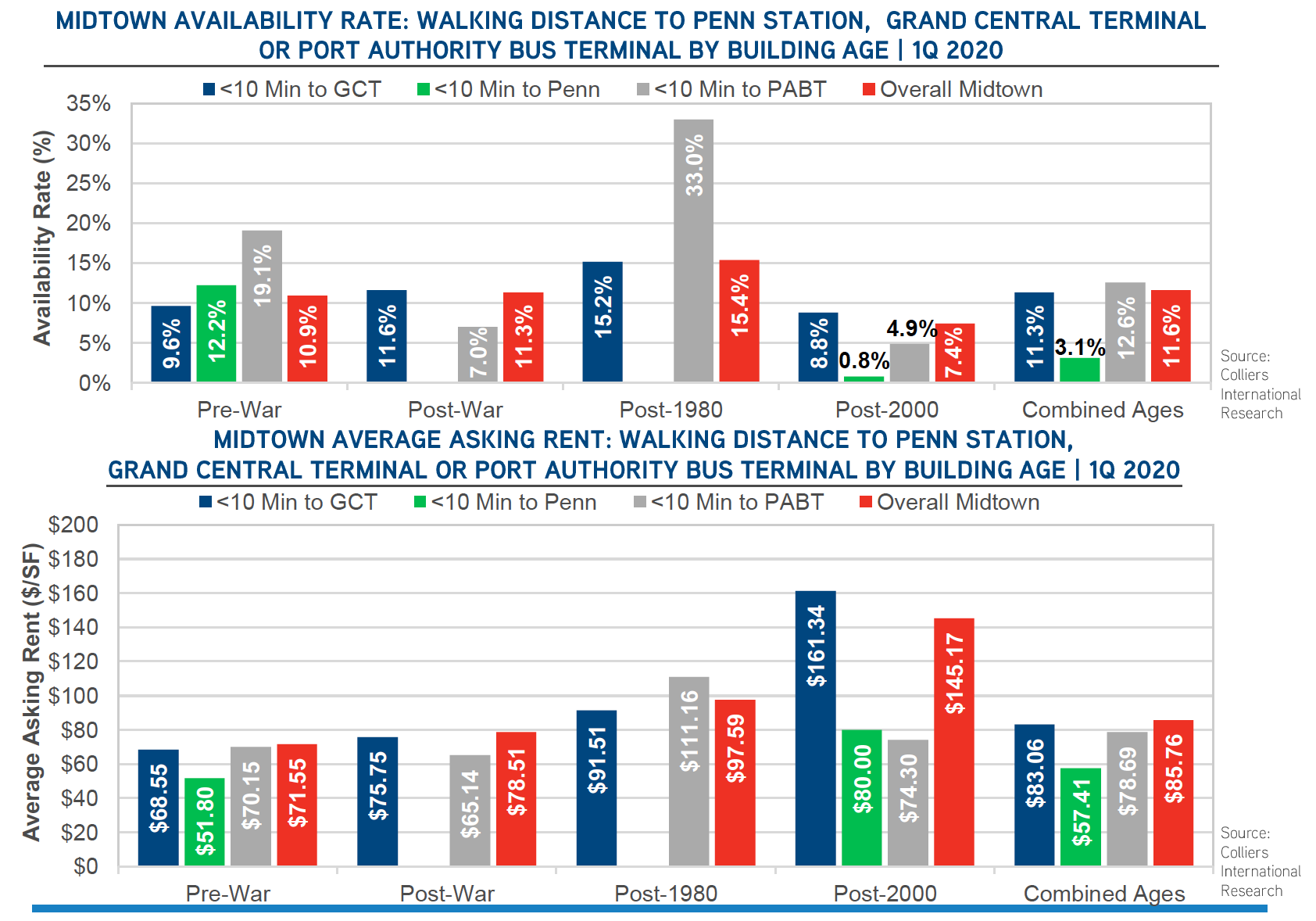

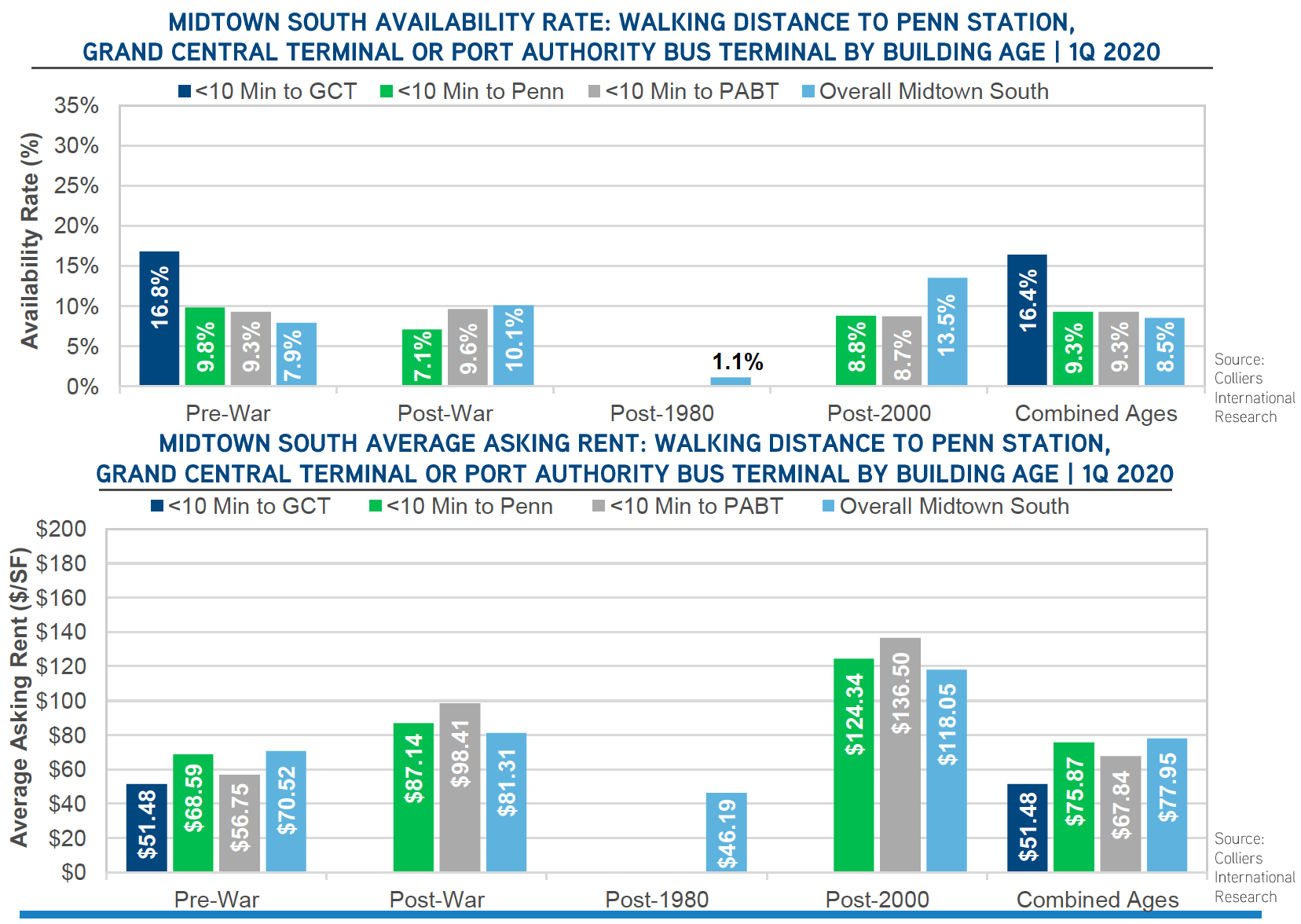

Finally, as shown in the below graphs, the report takes a detailed look at availability and asking rents for office space near each of the main transport hubs, also taking into account the era in which the space was built: