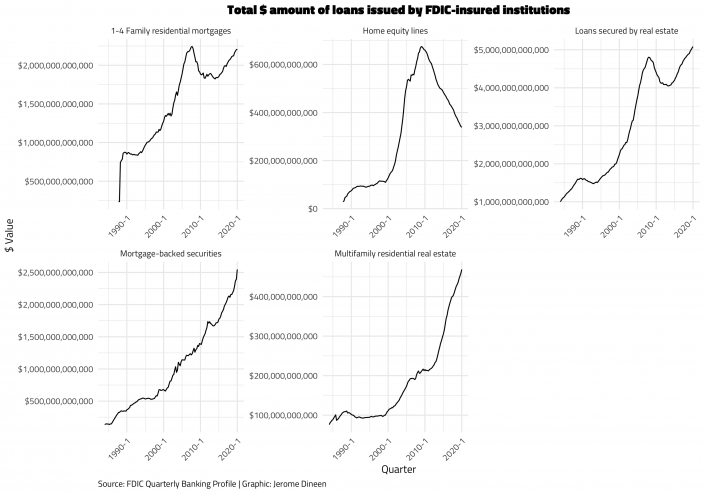

Federally-insured banks boosted their real estate lending to historic highs in the first quarter of 2020, before the coronavirus took hold.

According to a Q1 report from the Federal Deposit Insurance Corporation, banks reached an all-time high from January through March by providing $5 trillion in real estate lending. At the same time, FDIC-insured banks’ aggregate net income fell by 70 percent, to $42.4 billion in the first quarter.

The record-breaking real estate loan total continued a run of increases since the second quarter of 2018.

Loans issued to most classes of real estate have been rising steadily in the last decade as well.

Mortgages for one- to four-family homes increased 4 percent to $2.2 trillion compared to the first quarter of 2019. And loans on multifamily properties rose 7.5 percent to $469 billion.

The only real estate loan to drop in the first quarter was home equity lines of credit (HELOC) loans, which have fallen steadily over the last decade. From January through March, HELOCs fell to $338 billion, down 7.4 percent from the same period in 2019.

The coronavirus has further accelerated that drive away from HELOCs. JPMorgan, the fourth largest mortgage lender in the country, announced in April it would temporarily stop taking HELOC applications to field a wave of refinancings.

According to the FDIC report, the first quarter also saw a jump in the sale of mortgage-backed securities, which rose by 14 percent to $2.5 trillion.

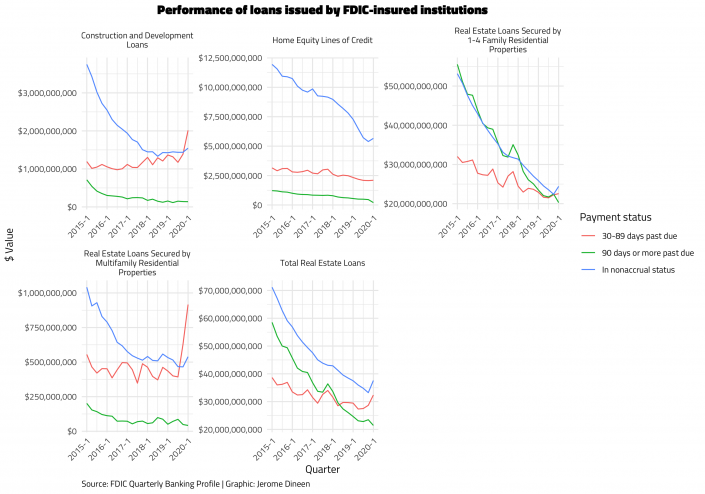

Loan performance in the first quarter was strong, likely because the virus took hold in the U.S. in the last two weeks of the quarter. Loans with payments that were 90 days or more past due dropped across all major real estate loan classes. That has all changed in the months that followed, as the country soon went under stay-at-home orders, with nonessential businesses ordered to shut and with tens of millions of people losing their jobs.

Also during Q1, the total dollar value of multifamily loans with payments between 30 and 89 days past due actually jumped. That total rose 110 percent to $916 million. For construction and development loans, the figure increased 47 percent to $2 billion.

The second quarter is expected to be a very different story, with the government shutdowns hitting real estate lending and loan performance particularly hard.

Banks have pulled back from mortgage lending and tightened their credit standards. And as of last week, the number of homeowners in forbearance plans reached 4.3 million.

On the commercial side, CMBS delinquencies have spiked. Fitch reported that the number of CMBS transactions transferred to special servicers is double its level at the end of 2019.