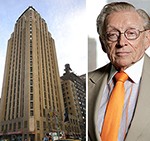

Located one block north of the United Nations, Beekman Tower was built in 1928 and is an early example of Art Deco architecture. In its early years, it housed sorority sisters who had moved to New York after having graduated from college.

Today, the 178-unit landmark property primarily serves as corporate housing for short-term and extended stays — an income stream that has taken a serious hit from the coronavirus crisis.

Now, a $63 million CMBS loan on the building — provided by Loancore Capital — is more than 30 days late, according to Trepp, and the borrower has requested Covid-19 relief for the loan.

While the growing list of properties facing coronavirus-related financial distress is well documented and the history of the 26-story Beekman Tower is well known, its current ownership had remained a mystery.

Yakov Mikhailovich Yakubov

But loan documents, court filings and Russian news reports indicate the property is owned by Yakov Mikhailovich Yakubov, a retail king from the former Soviet Republic of Azerbaijan. Yakubov has extensive holdings in a prime Moscow neighborhood, and his family has a massive real estate portfolio in the U.S.

When Silverstein Properties sold the 143,000-square-foot Beekman Tower in 2015, the buyer was reported only as an “unnamed foreign investor.”

Read more

Paper trail

Loan documents associated with a CMBS securitization, however, indicate the sponsors and guarantors of the Beekman loan are Yakov Yakubov, Thomas Yakubaros, and Yakubov US Trust 2013.

“The Yakubov family has over 30 years of experience developing, managing and investing in various types of real estate assets throughout the Russian Federation and the United States,” the prospectus notes. The family’s U.S. real estate portfolio includes 5 million square feet of retail, residential and office properties, it said.

A pre-sale report from Kroll provides more detail on those holdings, noting that the Yakubov family’s portfolio includes an 84-unit apartment building in New York, and three retail assets totaling approximately 820,000 square feet in Florida, Georgia and Wisconsin.

Lawsuits in New York and Moscow — which can both be linked to the same Cyprus-based shell corporation — confirm that the loan borrower is Yakov Yakubov.

“Unnamed foreign investor”

Silverstein’s 2015 sale of Beekman Tower ran into a few obstacles before making it across the finish line.

That January, a group affiliated with Brooklyn investor Chaim Miller signed a contract to buy the tower for $137.5 million. In April, however, Silverstein took Miller to court over his failure to close the deal, one of the many lawsuits Miller found himself entangled in that year.

Silverstein and Miller settled their dispute soon after, and the “unnamed foreign investor” stepped in to help Miller close on the $139 million acquisition in July, with Eastdil Secured advising on the deal. But the lawsuits didn’t stop there.

Also that year, a Chinese investor who was part of the original buyer group sued Miller and associates for $14 million in connection with the botched initial sale. And real estate broker Vasilios Vasiliu sued Miller and the new buyer over a $2.75 million commission he believed he was owed for making the first deal possible.

Both suits hinged on the question of whether Miller had any interest in the new buyer entities, Beekman Towers LLC and Beekman Towers Holdings LLC. But the opaque structure of those entities made that difficult to determine.

“It’s a shell game. It’s like a slippery fish,” said then-New York State Supreme Court Judge Jeffrey Oing in a July 2015 hearing on the investor lawsuit. “I can’t figure out where they are. Everywhere I turn they made another turn. Just when I’m ready to catch them, they make a left turn.”

The legal proceedings led to the disclosure of sale documents which Beekman Towers presented as evidence that it had no connection to Miller. Notably, a number of promissory notes associated with the sale were guaranteed by another entity, 2814-2824 Emmons Acquisition, LLC, which was itself entangled in several lawsuits surrounding a restaurant and nightclub in Sheepshead Bay.

A 2011 report from Forbes Russia, which called Yakubov the “king of real estate on Tverskaya” — a well known thoroughfare in Moscow — noted that he “diligently avoids” media attention and that his properties are all owned through offshore companies or registered under the names of associates. In 2014, Forbes ranked Yakubov as Russia’s 26th-largest commercial landlord by income, pulling in $85 million a year in rent.

In Russia, Yakubov is known for having illegally built an opulent mansion on government property in Moscow, in an amusement park. Local authorities have sought unsuccessfully to seize the property, which is owned by the same Cyprus shell company that indirectly controls the Sheepshead Bay building.

Attempts to reach Yakubov and his family were unsuccessful, and the lawyers who represented the buyer in the 2015 deal did not respond to requests for comment. Silverstein Properties and Miller declined to comment.

Contact Kevin Sun at ks@therealdeal.com