Trending

TRD Insights: Why mortgage rates aren’t under 3% (yet)

Challenges in retail mortgage market have kept rates higher than expected

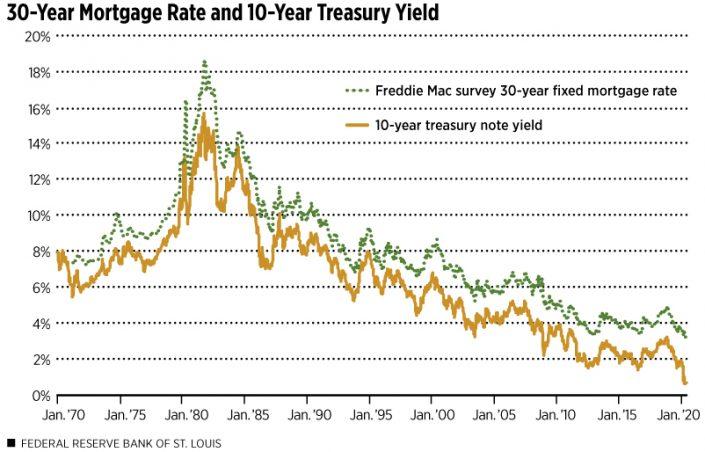

Days after Covid-19 was declared a pandemic, the Federal Reserve took the drastic move of cutting its benchmark interest rate to near zero. Mortgage rates fell in response — but not as much as expected.

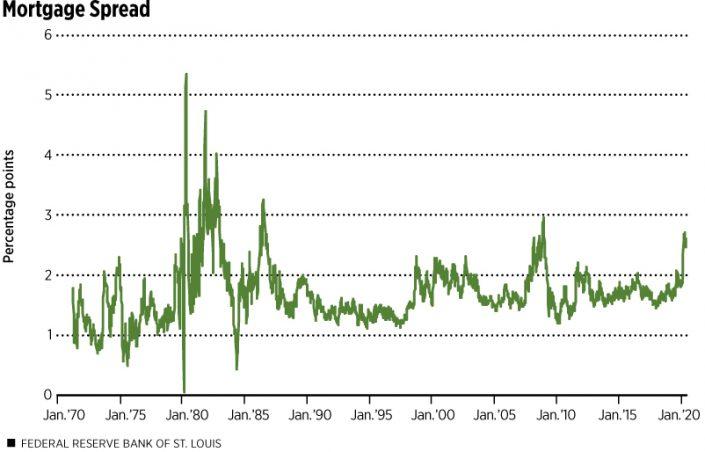

While the 10-year Treasury yield has dropped by 1.2 percentage points since the start of the year, the 30-year fixed rate mortgage average has fallen by just half that amount. The gap of about 2.5 points between the two figures is the largest it has been since late 2008, when the financial world was in chaos.

That has central bankers worried. They wanted the falling Treasury yield to pull mortgage rates down further.

“The Federal Reserve is concerned about the incomplete transmission of Treasury yield declines to mortgage borrowers because changes in mortgage rates are an important way monetary policy affects the economy,” wrote Bill Emmons, an assistant vice president and economist at the Federal Reserve Bank of St. Louis, in a June 15 report.

The report notes that the spread between the rates can be broken into pieces that reflect “the two links in the chain connecting capital markets to individual mortgage borrowers.”

First is the primary or retail mortgage market, in which lenders provide loans to individual homeowners. Then, in the secondary or wholesale mortgage market, those loans are bundled and sold to “securitizers” such as Fannie Mae, Freddie Mac, Ginnie Mae and private banks that sell mortgage-backed securities to investors.

“Most mortgage originators — especially those that are not banks — operate like brokers or dealers in mortgages,” the report says. “That is, they keep one eye on the wholesale market — the prices paid by Fannie Mae and Freddie Mac for mortgages — and the other eye on retail mortgage–market conditions.”

The St. Louis Fed’s analysis finds that difficulties facing the retail mortgage market helped prevent mortgage rates from falling further. “Some observers suggest many leading nonbank mortgage originators and servicers are financially weak, preventing complete pass-through of capital-market yields to household borrowers,” the report notes.

Based on analysis of how rates evolved during the Great Recession, the report expects that some of the challenges facing the retail mortgage market — including capacity constraints, risk aversion and slacker competition — will fade, and mortgage rates will fall to historic lows of less than 3 percent.

“If not, reforms of the mortgage origination or servicing sectors may be in order,” the report says.

Even with mortgage rates not falling more, the mortgage market has been booming. Mortgage applications to buy homes have hit a 11-year high this month, according to the latest data from the Mortgage Bankers Association.