As the coronavirus crisis was intensifying in late March, auditors raised the alarm that a Related Companies subsidiary might struggle to pay off $200 million in Israeli bonds that would come due in the fall. Related Commercial Portfolio assured investors that it was pursuing numerous options to ensure it met its obligations, and after months of negotiations, bondholders now have a specific proposal to vote on.

The proposed debt settlement envisions an early redemption of $74.5 million of the bonds’ principal, while the payment of the remaining balance — $121.5 million — will be postponed by a year to September 2021. The interest rate on the bonds will be increased from 5.1 percent to 7 percent.

RCP CEO Richard O’Toole said he believes the arrangement “constitutes an expression of faith in the company, its assets and its abilities,” according to an affidavit filed Tuesday with the Tel Aviv Stock Exchange.

O’Toole, who is also Related Companies’ general counsel, added it creates an “alignment between the structure of the capital and the debt of the company and between the operational requirements in the current times.”

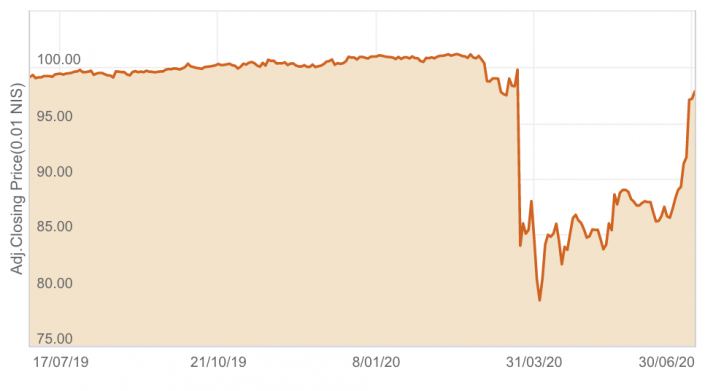

The Israeli bond market responded positively to the news, with RCP’s bonds rising back above 95 cents on the dollar for the first time in three months.

Read more

Funds for the early redemption will come from a number of sources. Related Companies — as RCP’s sole shareholder — will provide $12.5 million in cash as well as a $35 million guarantee for the refinancing of an office condominium unit at the 54-story Time Warner Center. RCP’s own liquidity will cover the rest.

A separate disclosure indicates that First Republic Bank is providing a $75 million refinancing for the Time Warner Center unit, which spans the 18th and 19th floors and is occupied by Related itself. The same lender previously provided a $30 million mortgage on the property in 2014, according to property records.

In the event that RCP is unable to pay off the outstanding balance on the bonds next year, Related has also committed to purchase its subsidiary’s stakes in the Time Warner Center condo and the Bronx Terminal Market, whose proceeds will be used to pay off the bonds.

RCP owns a roughly 41-percent stake in the 912,000-square-foot Bronx Terminal Market, according to its financial reports. A recent appraisal — which included the assumption that Covid-19 would be largely contained in the first half of 2020 — valued the retail power center at $620 million.

Related’s bondholders are set to meet via Zoom on July 13, and will have until July 15 to vote on the proposed settlement. A 75-percent majority is needed for the proposal to be accepted.

While the Tel Aviv-listed RCP portfolio represents a relatively small piece of Related’s extensive holdings in real estate and beyond, Stephen Ross’ larger firm has also faced numerous challenges as a result of the coronavirus pandemic.

The developer recently halted payments to EB-5 investors on the Hudson Yards megadevelopment, citing “extremely challenging conditions” in the residential condo market and the bankruptcy of its mall anchor tenant, Neiman Marcus. Related is now reportedly marketing the Neiman space for office use.

Elsewhere in Manhattan, Related has sold the residential component of One Union Square South — well known for the “Metronome” public artwork on its facade — to an unidentified overseas buyer for $200 million.

A Related spokesperson did not respond to a request for comment.

Contact Kevin Sun at ks@therealdeal.com