Even in the best of times, market-value rent resets on ground leases have been notorious for causing disputes between building owners and the lessors of the ground underneath them.

And then there is what’s happening at the famed Lipstick Building, where the coronavirus has fueled an increasing number of problems that started in May. That’s when the office building owner — a partnership led by Argentina’s Inversiones y Representaciones Sociedad Anónima, or IRSA — defaulted on ground lease payments.

This caused Ceruzzi Properties, which leases the ground under the 34-story tower to IRSA, to miss a mortgage payment the following month, with the $272 million CMBS loan getting transferred to special servicing. That loan is now more than 30 days delinquent, according to Trepp.

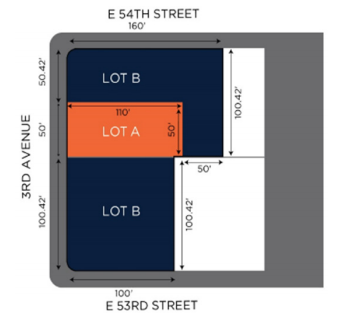

The latest wrinkle has presented itself because Ceruzzi and partners Shanghai Municipal Investment and SL Green don’t own all of the ground under the building at 885 Third Avenue. Now, the LLC that owns a 5,500-square-foot parcel under the building, facing Third Avenue, wants to increase the ground rent nearly fivefold to $3.5 million a year. SL Green objects to the increase, and filed a lawsuit last month to have the property properly appraised, which would likely yield a lower value and lower rent.

Diagram showing location of Lot A. Source: Loan Prospectus via Trepp

According to the terms of the ground lease on the parcel known as Lot A, the annual rent was to be reset to 8 percent of the land’s market value on May 1. The ground rent for the next 20 years would be determined by an appraisal of the value of the land in 2020.

The LLC, called 3 Company, contends that two appraisers had already agreed on the value of the parcel in early March. But SL Green — which has a $135 million preferred equity stake in the Ceruzzi partnership — argues the appraisal process was not concluded properly.

In SL Green and Ceruzzi’s view, 3 Company is relying on an unwritten agreement between two appraisers, from shortly before the onset of the coronavirus crisis. SL Green and Ceruzzi call the move “a desperate and belated attempt to avoid” taking into account the pandemic’s effect on real estate prices, “and the economic depression that has resulted therefrom.”

According to the ground lease, in order to determine a fair valuation for the property, the tenant and landlord were each to name an appraiser, and if the two could not come to an agreement within 30 days, a third “neutral” appraiser would have to be brought in to settle the matter. SL Green’s petition argues that the 30-day time limit expired long ago, since the appraisers were first selected last October.

IRSA’s default complicated things further. Because the building owner was responsible for covering ground rent payments to 3 Company, IRSA originally selected an appraiser on Ceruzzi’s behalf last fall. SL Green contends that IRSA’s default wiped out its interest in the appraisal determination, and that the appraiser it had selected should be replaced.

In a June 5 letter, 3 Company’s lawyers rejected SL Green’s move to appoint a new appraiser, calling it “unacceptable, improper, and without any basis.” The landlord says that the new assessed value of Lot A is more than $44 million, resulting in the $3.5 million annual ground rent — a significant increase from the previous amount of $759,000 per year.

Don’t cry for me, Argentina

Before failing to come up with its May ground rent payment, IRSA’s partnership — which also includes Guess founders Paul and Maurice Marciano — had already been in a tough financial position for some time, public disclosures show.

According to IRSA’s latest annual filing with the SEC, the partnership recorded a net loss of $36.8 million on the property for the year ending June 30, 2019, and a balance sheet deficit of $215 million.

While the base ground rent before recent resets was around $18 million a year, a $27 million “straight-line rent adjustment” was added for accounting purposes. That made total ground rent expenses $45.5 million.

Meanwhile, base rent revenue for the same period totalled $42.6 million.

The Lipstick Building’s largest tenant, law firm Latham & Watkins, does not intend to renew its roughly 400,000-square-foot lease next year. The law firm accounts for 65 percent of the 592,000-square-foot building’s rentable floor area, and about 75 percent of the base rent.

In April 2019, IRSA allowed a purchase option on the ground lease to lapse, and Ceruzzi began marketing the property for sale a few months later. The SEC filing notes that IRSA had another opportunity to buy out the ground lease for $521 million this past April, an option which has evidently also expired.

Ceruzzi and SL Green declined to comment. Representatives for 3 Company and IRSA did not respond to requests for comment.

Contact Kevin Sun at ks@therealdeal.com

Read more