As many Americans returned to work, mortgages in forbearance fell for the third consecutive week.

Home loans in forbearance made up 8.39 percent of servicers’ portfolios for the week ending June 28, according to figures released Monday by the Mortgage Bankers Association. That’s down from 8.47 percent for the week ending June 21 and from 8.48 percent for the week before. Nearly 4.2 million homeowners are now in forbearance plans, the lowest level in months.

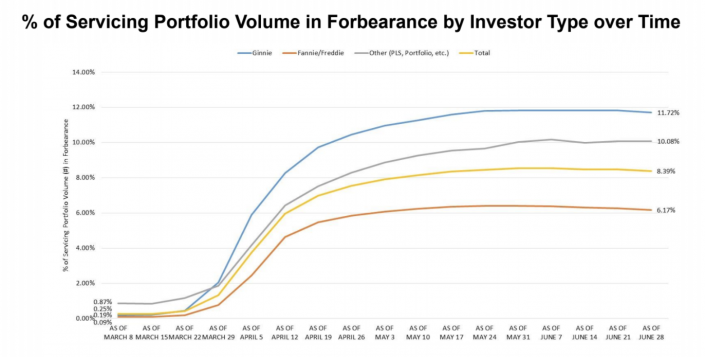

Homeowners often request forbearance in times of hardship, when they can’t make interest payments on their mortgages. It was seldom for the forbearance rate to exceed 1 percent before the coronavirus pandemic. The forbearance share for the first week of March, for example, was 0.25 percent.

The $2 trillion CARES Act allowed homeowners with loans backed by government agencies to request forbearance for up to a year.

Now that Americans are returning to work, they may be less likely to ask for help from the bank. The U.S. beat economists’ expectations in June, adding 4.8 million jobs and lowering the unemployment rate to 11.1 percent, according to the U.S. Bureau of Labor Statistics.

“We learned last week that the job market improved more than expected in June,” said Mike Fratantoni, MBA’s chief economist, in prepared remarks. “With that as background, it is not surprising that the forbearance numbers continue to improve as more people go back to their jobs.”

Forbearance rates often vary by the kinds of institutions that keep the mortgages on their balance sheets. Rates are typically higher for low-interest, low-credit loans issued by federal agencies and guaranteed by Ginnie Mae. Ginnie Mae loans in forbearance dropped to 11.72 percent in the week ending June 28, down from 11.83.

Mortgages purchased by Fannie Mae and Freddie Mac, both government sponsored entities, saw forbearance rates drop for the fourth week in a row to 6.17 percent, down 9 basis points from the week prior.

Finally, the forbearance share for loans originated by portfolio lenders or purchased by private labels reached 10.08 percent, up 1 basis point from the week prior.

As the number of loans in forbearance dropped, so did the rate of forbearance requests from homeowners. Forbearance requests as a percentage of servicing portfolio volume decreased to .12 percent, down from .14 percent the week ending June 21.

Although fewer borrowers are requesting forbearance, many that have exited forbearance plans are still asking for loan modifications and deferrals, Fratantoni said. As coronavirus cases surge nationwide, it’s also possible that reopening in the U.S. will lose the momentum it gained in June.