Mortgages in forbearance fell for the fourth consecutive week as many Americans returned to work after being furloughed or laid off.

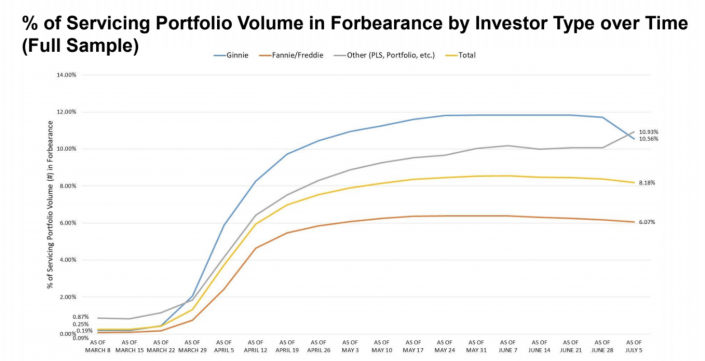

Home loans in forbearance made up 8.18 percent of servicers’ portfolios for the week ending July 5, according to figures released Monday by the Mortgage Bankers Association. That’s down from 8.39 percent for the week ending June 28 and from 8.47 percent for the week prior. Roughly 4.1 million homeowners are now in forbearance plans.

Homeowners often request forbearance in times of hardship, when they can’t make interest payments on their mortgages. The forbearance rate rarely exceeded 1 percent before the coronavirus pandemic.

Although many Americans returned to work last week, the MBA found that more than four in 10 mortgagors in forbearance plans asked for extensions beyond the initial term. The percentage of Americans exiting forbearance who asked for deferrals, meaning borrowers who requested to push off loan payments until a later date, dropped to just over 10 percent from 16 percent the week prior.

Forbearance rates often vary by the kinds of institutions that keep the mortgages on their balance sheets. Rates are typically higher for low-interest, low-credit loans issued by federal agencies and guaranteed by Ginnie Mae.

This week was different, however, because many Ginnie Mae-guaranteed loans were bought out of Ginnie Mae MBS pools by bank servicers and moved on to bank balance sheets.

“These buyouts enable[d] servicers to stop advancing principal and interest payments, and to work with borrowers in the hope that they can begin paying again before they are re-securitized into Ginnie Mae pools,” MBA chief economist Mike Fratantoni said in prepared remarks.

For this reason, the Ginnie Mae forbearance rate dropped below that of portfolio lenders or private labels for the first time since the coronavirus pandemic hit the United States. Ginnie Mae’s share of loans in forbearance dropped to 10.56 percent in the week ending July 5, down 116 basis points from the week prior. Meanwhile, the forbearance share for loans originated by portfolio lenders or purchased by private labels jumped to 10.93 percent, up 85 basis points from the week prior. This was the biggest movement in forbearance rates for loans of both vintages in several months.

Mortgages purchased by Fannie Mae and Freddie Mac, both government sponsored entities, saw forbearance rates drop for the fifth week in a row to 6.07 percent, down 10 basis points from the week prior.