Signature Bank, one of New York City’s most active multifamily lenders, was “pleasantly surprised” by rent collections during the last quarter.

Its $15 billion multifamily portfolio, which accounts for 30 percent of its total holdings, saw rent collections top 80 percent during the second quarter, the bank reported during an earnings call Tuesday.

Still, $9.4 billion of the loans in Signature Bank’s $50 billion portfolio remain in deferral. That’s down from $10.9 billion at the height of the coronavirus pandemic. By July 15, $2.2 billion of those loan deferral agreements were scheduled to expire, and $1.3 billion of those, or 60 percent, began paying again, Joseph DePaolo, president and CEO of Signature Bank, said the earnings call.

Read more

Most of the loan forbearance agreements provided to borrowers expire between August and September. The bank will consider giving borrowers additional time on a case-by-case basis.

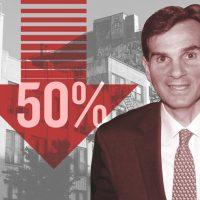

Community banks, including Signature Bank, are the primary lenders for the roughly 1 million rent-stabilized apartments in New York City. Signature Bank’s rent-stabilized portfolio — which accounts for roughly half of its multifamily loans — took a beating during the first quarter of 2020, with rent collections falling 50 percent.

Despite the increased rent collections over the last three months, Signature Bank reported second quarter income of $117.2 million, a small increase from $99.6 million the first quarter but down from $147.3 million during the same period in 2019.

Office rent collections for the quarter ranged from 65 to 80 percent, and retail rent collections ranged between 35 and 65 percent of normal levels, DePaolo said.