Mortgages in forbearance dropped to the lowest level in two months.

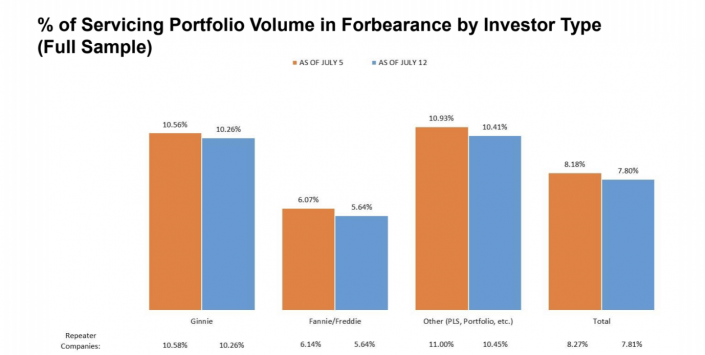

Home loans in forbearance made up 7.8 percent of servicers’ portfolios for the week ending July 12, according to figures released Monday by the Mortgage Bankers Association. That’s down from 8.18 percent for the week ending July 5 and from 8.39 percent for the week prior. About 3.9 million homeowners are now in forbearance plans.

Homeowners often request forbearance in times of hardship, when they can’t make interest payments on their mortgages. The forbearance rate rarely exceeded 1 percent before the coronavirus pandemic.

As more Americans returned to work, the pace of new forbearance requests has slowed, while the pace of exits from forbearance plans has quickened. Still, MBA Chief Economist Mike Fratantoni said he would be watching carefully for an uptick in forbearance requests as the end of expanded unemployment insurance looms and coronavirus cases surge nationwide.

Forbearance rates often vary by the kinds of institutions that keep the mortgages on their balance sheets.

Ginnie Mae’s share of loans in forbearance dropped to 10.26 percent in the week ending July 12, down 30 basis points from the week prior. Meanwhile, the forbearance share for loans originated by portfolio lenders or purchased by private labels jumped to 10.41 percent, down 52 basis points from the week prior.

Mortgages purchased by Fannie Mae and Freddie Mac, both government sponsored entities, saw forbearance rates drop for the fifth week in a row to 5.64 percent, down 43 basis points from the week prior.