In December 2018, Google CFO Ruth Porat announced plans for the search giant’s new 1.7 million-square-foot campus in Manhattan’s Hudson Square, a move that would allow the company to “more than double the number of Googlers in New York over the next 10 years.” It was the latest in a series of billion-dollar moves that had made Google one of the most consequential office tenants in core U.S. office markets, with a large presence in New York, Los Angeles, and Chicago.

Now, the company has announced plans to extend remote work until at least July 2021. The decision applies to nearly all 200,000 employees of Google parent Alphabet, and covers workers in most of the company’s major offices, including its Mountain View, California, headquarters and offices in the U.S., United Kingdom, India, Brazil and elsewhere.

Google’s decision could signal the reversal of the company’s 20-year quest for more office space in coastal cities it saw as hubs of talent. It could also portend the upheaval of office markets in metros across the globe, with some speculating that its competitors could soon follow suit.

This is a big deal since Google is a lot smarter than our government: The move will affect the vast majority of the roughly 200,000 full-time and contract employees across Google parent Alphabet, and is sure to pressure other technology giants https://t.co/v69DZ4V4tT via @WSJ

— Kara Swisher (@karaswisher) July 27, 2020

There will be a big ripple effect from the Google announcement extending WFH to July 2021. Other companies will match. WFH, or hybrid, is the new normal.

— Spencer Rascoff (@spencerrascoff) July 27, 2020

Since the turn of the century, the search engine titan has steadily expanded its footprint on both coasts in the United States, starting in Silicon Valley and then supersizing space commitments on the East Coast.

In December 1999, the company inked its first Manhattan lease at 1440 Broadway in Times Square. Google grew its footprint at that location to 170,000 square feet over the next several years. Later, it signed a pair of mammoth leases at RXR Realty and Youngwoo & Associates’ Pier 57 project, and in late 2018 announced it would bring 7,000 employees and invest $1 billion into a trio of properties totaling 1.7 million square feet in Hudson Square. All told, as of November 2018, Google occupied 3.35 million square feet and owned 4.7 million square feet in New York City, according to Yardi Matrix data.

In Los Angeles, Google joined a tech pilgrimage to “Silicon Beach,” leasing up to 100,000 square feet at the Frank Gehry-designed Binoculars Building in Venice in 2011. Five years later, the company tripled its LA footprint by leasing the entirety of a 319,000 square-foot former airplane hangar in Playa Vista known as the “Spruce Goose.”

Read more

That appetite for office space wasn’t strictly coastal. Google’s lease commitments in downtown Chicago total 1.3 million square feet, and its decision to move its midwest headquarters to the Fulton Market triggered a tidal wave of amenity-laden office development in the neighborhood.

The company’s real estate strategy has evolved away from leasing to ownership. Google bought 111 Eighth Avenue in the Meatpacking District for a record $1.8 billion in 2010, only to eclipse that deal eight years later by purchasing the Chelsea Market building for $2.4 billion. It is not clear how much space Google has taken up at its Eighth Avenue property, but one source said it could be as high as 800,000 square feet.

Those New York deals weren’t isolated events, but rather part of a series of acquisitions that grew Alphabet’s global real-estate portfolio to a valuation of $14.5 billion as of March 2018, according to Real Capital Analytics.

After Facebook, Twitter and Shopify announced remote-work plans, researchers and industry analysts published a flurry of reports and think pieces focused on what a corporate exodus could mean for major cities. The conclusions have been mixed, with some predicting urban demise and others urban resilience.

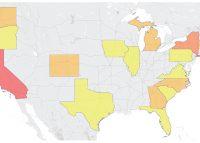

One survey from Redfin found that 61 percent of New York City residents would leave the city if they no longer had to commute to the office, citing the high cost of living as the chief reason for their departure. Before the coronavirus pandemic, 14 percent of survey respondents were working remotely most of the time. During the shutdowns, the share of those working from home shot up to 76 percent. In the San Francisco Bay area, that figure is 85 percent, though the transition to remote work has not been an entirely smooth one.

By contrast, a report from the Brookings Institution found that migration to downtowns nationwide has grown for decades, a trend that predates many tech companies’ move into major cities, and one that’s not likely to stop once they leave.