The coronavirus pandemic and its economic aftermath have put a damper on office leasing across the U.S. By one measure, the decline in demand for office space in the second quarter was the largest the country has seen since the dot-com crash.

Net absorption in the U.S. office market — the amount of space leased minus vacated space and new space — turned negative for the first time a decade in the second quarter, totalling 21.5 million of negative absorption, according to a new report from CBRE. That’s slightly worse than the 21.2 million single-quarter decline seen at the peak of the financial crisis, but still well behind the massive 41.2 million square foot decline from the third quarter of 2001.

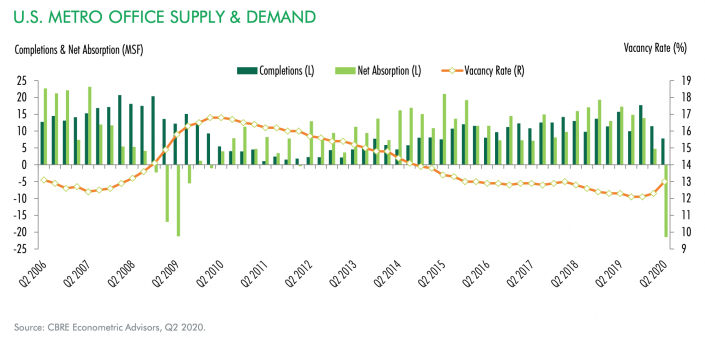

As the below chart from the report shows, the 2008 financial crisis led to four consecutive quarters of negative net absorption in office markets nationwide. It remains to be seen how long the impact of the current disruption will last.

Other office leasing metrics also point to a major slowdown in the market. Leasing volume fell by 35 percent from the prior quarter and 44 percent from the same period last year. Vacancy ticked up 0.7 percentage points to 13 percent.

The slowdown hit some markets more heavily than others, with the NYC metropolitan area, California and Texas accounting for 72 percent of negative demand. Meanwhile, about a dozen markets in Southeast, Midwest, and Washington, D.C., still saw positive absorption.

The San Francisco market saw the most negative absorption of all, at 2.3 million square feet. At the other end of the spectrum, Tampa saw positive absorption of 360,000 square feet, the largest of any market.

Even after the massive decline in demand, San Francisco’s office market was still the second tightest in the country at 7 percent vacancy, surpassed only by nearby San Jose’s 6.7 percent.

The amount of available sublease space has begun to grow significantly in some parts of the country, with Phoenix and Salt Lake City seeing large increases in the second quarter. CBRE notes that this is “perhaps due to a greater ability to tour space than other markets that were more acutely affected by Covid-19 restrictions early in the crisis.”

Manhattan, for example, has yet to see a widely expected increase in sublet availability, while Los Angeles has seen sublease availability hit record levels.

Rents have also yet to drop noticeably despite the decline in demand, although CBRE notes that downward pressure is growing as landlords offer more concessions. But for now, “a significant difference in pricing expectations has emerged between landlords and tenants,” the report says.

Read more

Contact Kevin Sun at ks@therealdeal.com