When HNA Group paid $2.2 billion to acquire 245 Park Avenue in 2017, it put an exclamation mark on the company’s precipitous rise from a regional Chinese airline to a major global conglomerate.

But just a few months later, shifting political winds in China started to put pressure on HNA’s finances, and the 44-story office tower was back on the market in less than a year, as part of a $4 billion fire sale.

Two years later, HNA still owns the 1.7 million-square-foot trophy asset, although SL Green invested $148.2 million for a preferred equity stake in late 2018.

The property was 92-percent leased at the end of 2019, with the 10 largest tenants accounting for 97 percent of base rent, according to the latest surveillance report from Kroll Bond Rating Agency.

The largest direct tenant, JPMorgan Chase, pays the lowest rent by area at just $63 per square foot. HNA itself, which occupies 38,000 square feet in the building, also pays a relatively low rent of $74 a foot, while the average rent for the top 10 tenants comes out to $84 per square foot.

HNA financed its acquisition of the property with a $1.2 billion CMBS loan provided by JPMorgan Chase Bank, Natixis, Barclays, Deutsche Bank and Société Générale. Loan documents associated with the initial issuance — as well as annual surveillance reports from Kroll — provide the detailed look at what tenants and subtenants are paying at this prime Midtown office property.

Read more

The largest actual tenant at the building is Société Générale, which subleases 560,000 square feet from JPMorgan at about $61 per square foot, according to a Kroll report from 2017. The French investment bank uses the space as its U.S. headquarters, and already has a 10-year direct lease lined up that will take effect immediately after its sublease ends in 2022.

Los Angeles-based investment bank Houlihan Lokey also has a headquarters at the property. It subleases 91,000 square feet from JPMorgan at just $42 per square foot and another 25,000 square feet from Major League Baseball at $65 a foot, according to the 2017 rent roll.

MLB has one of the priciest leases at the property, at $131 per square foot, and is planning to relocate to its new headquarters at Rockefeller Group’s 1271 Avenue of the Americas — a move that has been held up by the coronavirus, according to Kroll. An appraiser found that MLB’s rent was about 30 percent above market rates for the space.

The priciest lease of all belongs to Dutch financial services firm Rabobank, which pays $138 per square foot for its 110,000 square foot space.

A portion of Ares Capital Corporation’s lease at the building was set to expire in April, and Kroll was unable to ascertain the current status of that space.

Citing the master servicer, Kroll notes that SL Green “acquired an approximate 49% non-controlling, indirect interest” in the property, though the structure of that interest is not detailed. In addition to its $148 million preferred equity stake that generates an 11% preferred return, SL Green has a $55 million mezzanine debt investment, and also collects fees for leasing and managing the property.

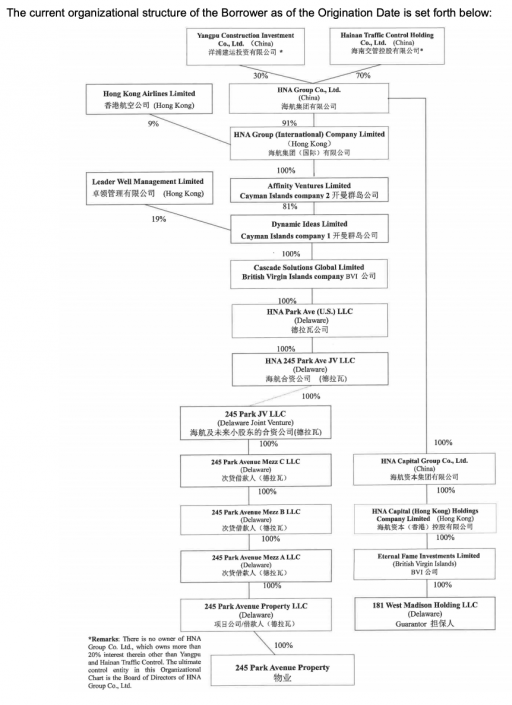

(245 Park Avenue ownership structure in 2017, prior to SL Green’s preferred equity investment.)