Vornado Realty Trust’s “financial engine” is chugging along with another closing.

A condo at 220 Central Park South sold for $49 million six months after its anonymous buyer went into contract in February, property records show.

The 4,820-square-foot unit was bought by a Delaware limited liability company, CPS Realty Partners, which went into contract for the condo weeks before the city shut down to hamper the spread of coronavirus. The transaction pencils out to $10,165 per foot.

Read more

The unit spans two floors in the 18-story “villa” portion of the Vornado’s Billionaires’ Row tower, which faces Central Park from West 59th Street. The towering portion of the building is nestled behind the villa structure.

CPS Realty’s condo, dubbed Villa-11, has 1,700 square feet of outdoor space and occupies the tenth and eleventh floors, the building’s offering plan shows. An attorney for the buyer did not respond to a request for comment.

The transaction is an outlier at the building for closing so quickly. Many buyers at the property, which has routinely seen record-breaking closings over the past nearly two years, committed to purchase their units years earlier.

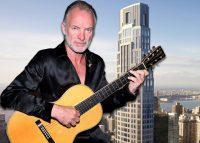

The duplex unit directly above was sold last year for $47 million, or $10,722 per square foot, to an anonymous buyer, while the quadraplex that caps off the villa structure was bought by musician Sting for $65.7 million, or $11,313 a foot, last year.

Of the 10 villa units at 220 Central Park South, there are three that haven’t yet sold. They include two nearly 4,900-square-foot units on the second and sixth floors, and a 7,900-square-foot duplex on the seventh and eighth floors.

The development has been a cash cow for Vornado. On the company’s second quarter earnings call, CEO Steve Roth referred to the project as a “financial engine,” with proceeds from sales pushing the firm’s total liquidity to $3.8 billion dollars. “If you’ll pardon the expression — we’re loaded,” he said.

Write to Erin Hudson at ekh@therealdeal.com