Another U.S. developer with bonds in Israel is facing a coronavirus cash flow crunch, and is seeking bondholder approval to restructure its debt.

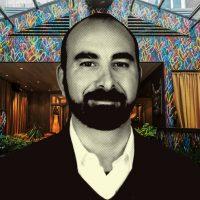

Alex Sapir’s Sapir Corp. has proposed a restructuring of its roughly $44 million (150 million shekel) bond series, with an immediate prepayment of about $8 million, a higher interest rate, and an extension of the maturity date by three years, according to documents filed over the past week on the Tel Aviv Stock Exchange.

In the absence of a restructuring, Sapir Corp. is expected to encounter cash flow difficulties and even a negative opinion regarding its status as a “going concern” in its upcoming quarterly earnings, according to corporate finance firm ClearStructure.

Bondholders appear to have received the proposal positively, and in the past week Sapir Corp.’s bond price has risen above 90 cents on the dollar for the first time since early March.

They are set to vote on the proposal on Monday, and a 75-percent majority is required for it to be accepted. According to Sapir’s filings, 70 percent of bondholders have indicated support for such a move.

Sapir Corp. owns the Nomo Soho hotel in Manhattan, the Arte luxury condo project in Miami, as well two development sites in New York and Miami that both hit the market last year.

But according to ClearStructure, Sapir Corp. has a net asset value of negative $6.8 million pre-restructuring. That valuation is driven by a number of large loans on the portfolio.

On the Nomo Soho, which ClearStructure values at $200 million, Sapir has a $114.4 million senior loan from Morgan Stanley and an $83.6 million loan from the estate of Tamir Sapir, Alex’s father, leaving a net value of just $2 million. A $62.9 million piece of the estate loan is subordinate to the Israeli bonds.

ClearStructure concluded the restructuring of Sapir’s debt is preferable both to the current state of affairs and to other alternatives considered. The firm noted that a liquidation is likely to result in a 20- to 40-percent loss at “fire sale” prices given the current global economy, while Sapir’s proposal will likely involve no loss.

Like much of the New York hotel industry, the Nomo Soho saw dismal occupancy rates in the early days of the pandemic. The hotel did not secure government contracts to house frontline workers, and has since begun offering rooms as workspace.

According to Sapir Corp.’s business plan, the company expects to have sold all properties except the Nomo Soho by the end of 2022. The broader Sapir Organization owns other properties in New York, including twin office buildings 260 and 261 Madison Avenue in Midtown.

Read more

According to the restructuring proposal, the $8 million (28 million shekel) prepayment of the bonds will be funded from a $14 million line of credit provided by Alex Sapir. Of the remaining principal, 1.5 percent or about $540,000 will be paid down every six months for the next three years, in January and July 2021, 2022 and 2023. The remaining $32 million will be paid in two halves in 2024 and 2025.

Under the current terms, Sapir’s $44 million in bonds were set to be paid off in two halves in 2021 and 2022. The restructuring will also increase the interest rate on the bonds from 4.8 percent to 6 percent.

Sapir declined to comment, citing securities regulations. Commercial Observer first reported the proposal.

Sapir Corp, which bought back its Tel Aviv-listed shares to go private in June, is not the first U.S. developer to ask Israeli bondholders to help it out in a bind.

In March, a Related Companies subsidiary was hit with a “going concern” opinion of its own, which led to a panic in the bond markets. The company later worked out a plan to restructure its roughly $200 million bond series, pushing the maturity date back from this year to next following a $75 million prepayment. That proposal was approved Tuesday, Tel Aviv filings show.

Contact Kevin Sun at ks@therealdeal.com