Despite fears of decreased spending amid the pandemic, big-box stores — plus Amazon — raked in the cash last quarter.

Walmart, Amazon, Target, Home Depot, Lowe’s and Costco accounted for 29.1 percent of all U.S. retail sales in the second quarter, up from 25.6 percent a year ago, the Wall Street Journal reported. That’s a 14 percent increase in market share.

Read more

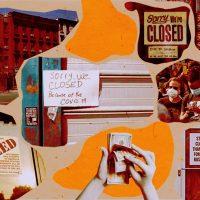

Meanwhile, sales at smaller retailers fell 7 percent between March and mid-August.

That’s partly thanks to measures that stores had previously put in place to compete with Amazon, streamlining the way for curbside pickup. Target saw revenue spike to $23 billion as digitally originated sales made up 17.2 percent of all sales for the quarter.

“We had a lot of the infrastructure in place, and we just had to ramp up,” Je’Varis Richardson, who oversees 13 Target stores in North Carolina, told the Journal.

While apparel sales fell for most stores, with those specializing in clothing sales paying only 46 percent of July rent, such spending rose in big-box stores.

The trend raises concerns for small competitors.

“We will see a sort of winnowing out of the folks who were already structurally disadvantaged against the big box,” Matthew Hamory, a managing director in the retail practice at consulting firm AlixPartners, told the Journal. [WSJ] — Sasha Jones