Atlanta-based Radco Companies has been unloading its multifamily portfolio, piling up cash for what it hopes will be a discount shopping spree.

This week alone the company sold six buildings in the Atlanta suburbs and one in Charlotte for a total of $315.6 million, CEO Norman Radrow told Bloomberg News.

Radco has sold 28 of the 59 apartment properties it has purchased since 2011, and it’s not done. The firm is marketing 18 rental communities and some of the deals are expected to close in the next couple of months, Radow said.

“We want to have the cash and capital available and be ready to take advantage of a new and interesting cycle that will be coming next year,” Radow said.

The pace of multifamily building sales has plummeted since the onset of the coronavirus in March. Landlords have expressed concerns about rent collection but have not been selling at a discount. Radrow believes that will change next year, and he wants to be ready to buy.

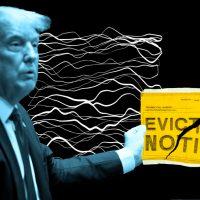

Valuing buildings became tricky when tenants’ ability to pay rent was thrown into doubt. Adding to the uncertainty, the Centers for Disease Control and Prevention on Tuesday unveiled an eviction moratorium that will run through the end of the year. The measure aims to keep renters in their homes but leaves landlords without options when tenants stop paying rent.

[Bloomberg News] — Akiko Matsuda

Read more