UPDATED, Sept. 11, 2020, 6:36 p.m.: After another lofty closing at 220 Central Park South, developer Vornado Realty Trust has just a few units left to sell at the luxury condo tower.

The sale of unit 72, the fourth-highest condo in the tower portion of the trophy property, closed on Friday for $62 million, according to Berkshire Hathaway HomeServices New York Properties. The brokerage’s JoAnne Kao represented the unknown buyer.

The sale of the 5,935-square-foot residence pencils out to $10,446 per foot.

Documents made public after this story’s publication showed that the final sale price of the unit was $63 million, not $62 million.

“As with most new development sales, there are upgrades and additional purchases that are negotiated directly between the buyer and the developer prior to closing that are not disclosed to other parties, including BHHS NYP,” the brokerage said in a statement.

Read more

In an interview, Kao said the unit went into contract early last year. She declined to elaborate on the transaction or her client, but she called the deal a symbol of the city’s resiliency.

“I naturally believe New York City is the best city in the world,” she said. “Don’t underestimate New York.”

The four-bedroom unit occupies an entire floor with a 140-square-foot terrace overlooking Central Park, according to the condo offering plan.

Billionaire Daniel Och closed on the duplex above it for $92.7 million, or about $9,490 a foot, late last year. The duplex on the top two floors of the Billionaires’ Row tower sold for $99.9 million, nearly $12,200 a foot, to an anonymous buyer in late July. Unit 75, which occupies a single floor between the duplexes, has not yet been sold, according to property records.

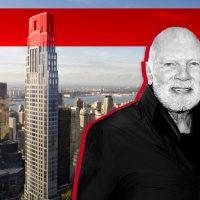

Eye-popping closings at the 220 Central Park South have been lining Vornado’s coffers to the point where CEO Steve Roth on a recent earnings call referred to the project the “financial engine” responsible for the company’s $3.8 billion in cash on hand in spite of its losses due to the coronavirus pandemic.

“If you’ll pardon the expression — we’re loaded,” he said.

The engine may soon run out of gas, however. As of Sept. 8, 30 of the tower’s 118 units — 89 residences and 29 staff units — have yet to be sold, according to an analysis of building records by The Real Deal. Of the 89 residences, the firm said in February that 91 percent had been sold. It is not clear how many units are currently in contract.

Corcoran Sunshine Marketing Group, which handles sales at the building, did not respond to request for comment. Neither did a representative for Vornado.

UPDATE: This story was updated to reflect the deed filed in public records and specify that of the 118 units at 220 Central Park South, 89 are residences and 29 are staff units.